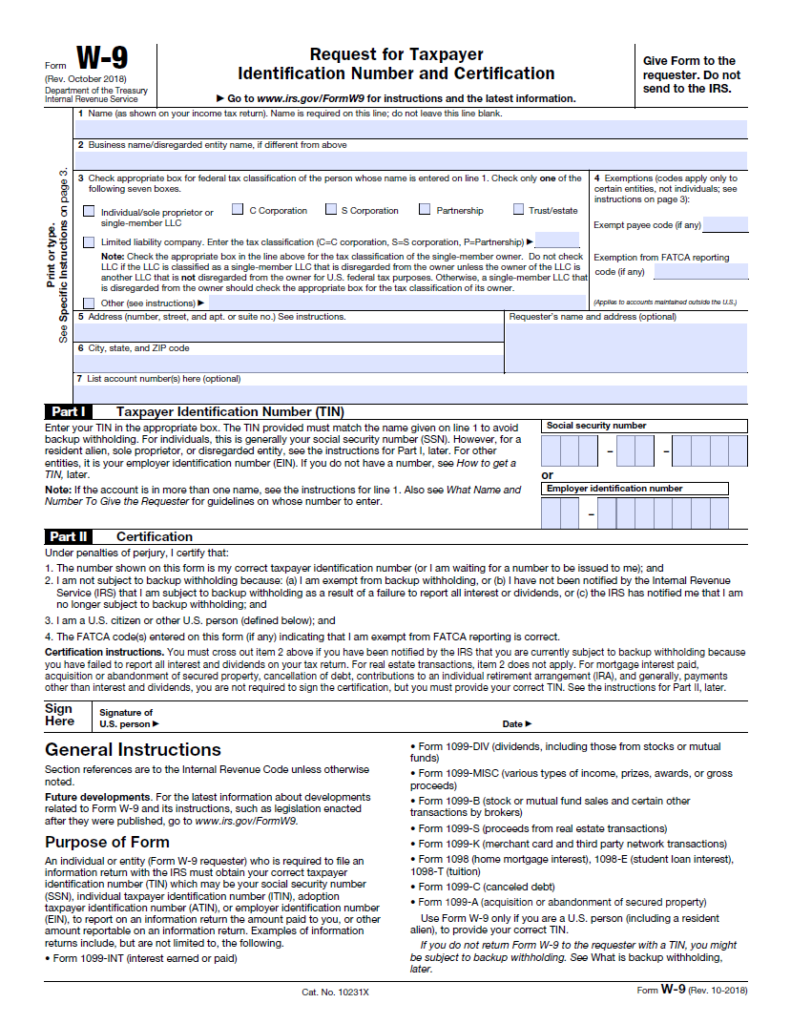

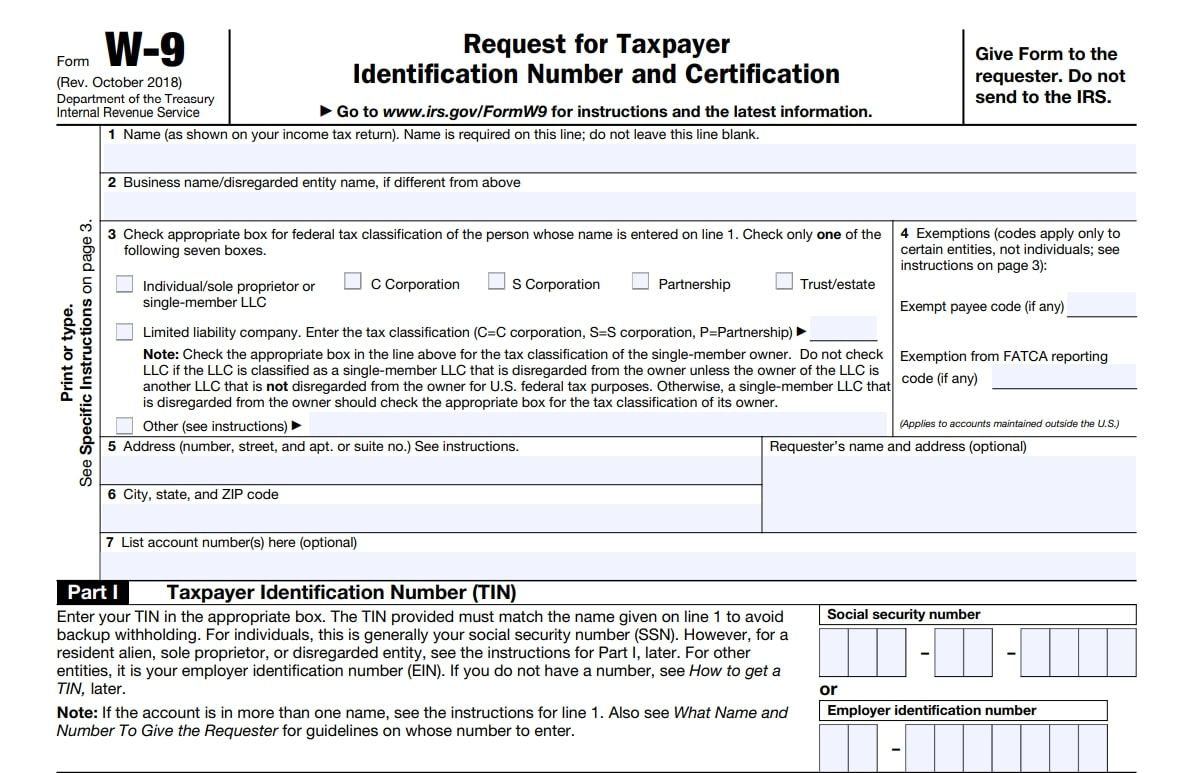

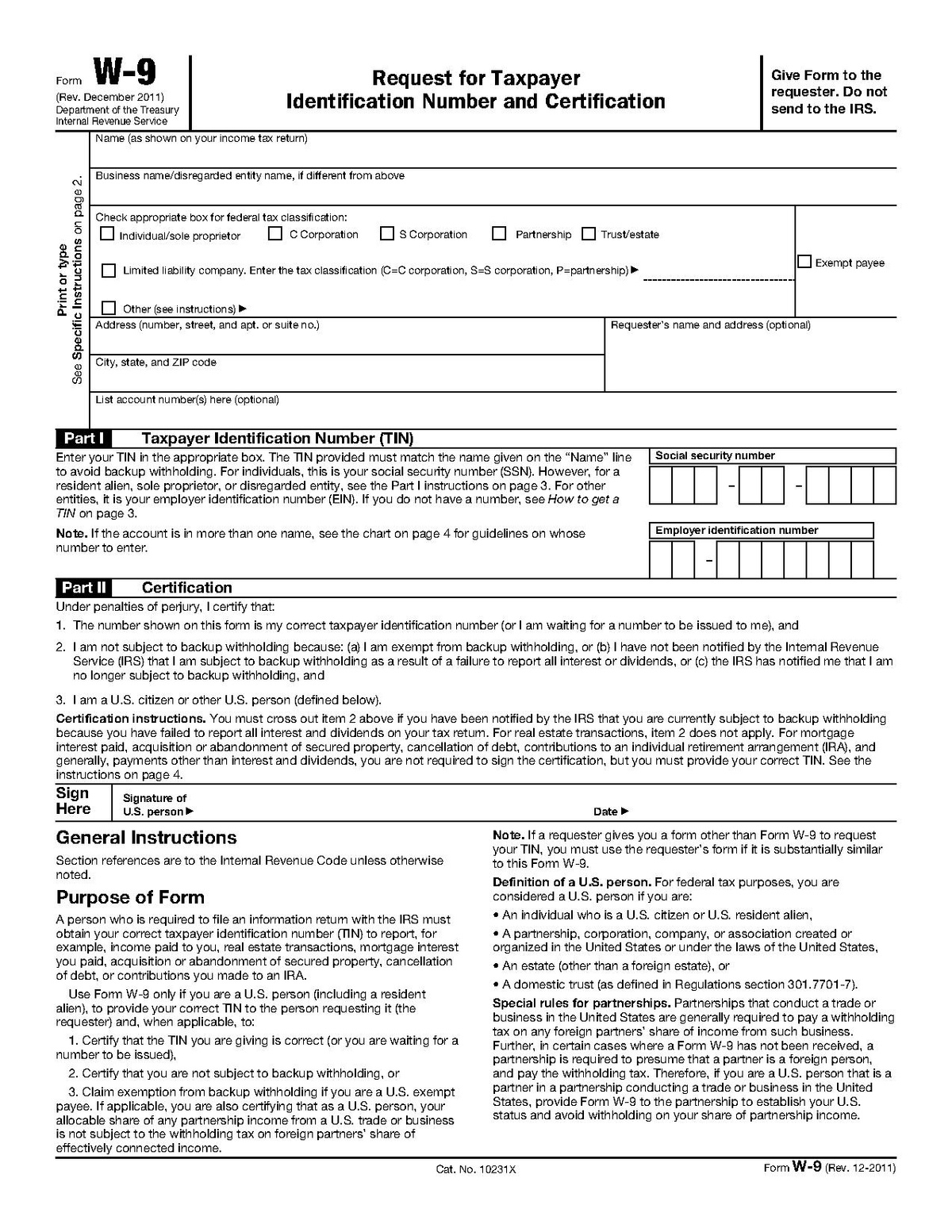

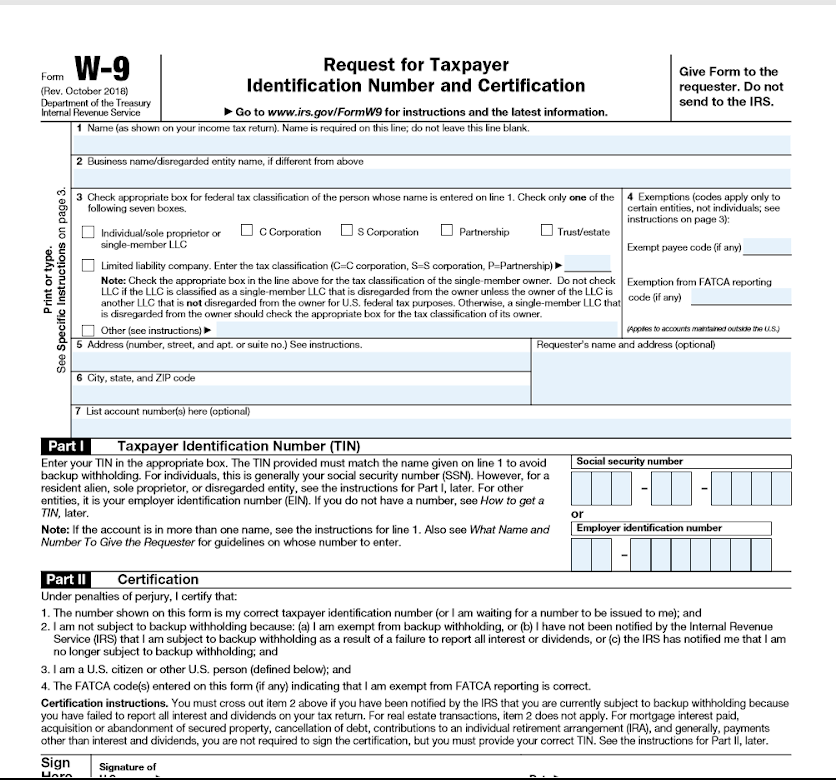

2022 Irs W9 Form – Form W-9–Request for Taxpayer Identification Number and Certification–is a generally used IRS form. When you function for a client, or in case your company is independent, they may ask that you fill out and return a W-9 to make sure they are able to prepare the 1099-NEC form accurately and then report the payments you obtain at the close of the year. 2022 Irs W9 Form

2022 Irs W9 Form

What is a 2022 Irs W9 Form ?

The W-9 or Request for Taxpayer identification Number and Certification form offers a company relevant information about a person contractor (IC), or freelancer to become used for tax purposes in America. This form asks for the IC’s name and address. The data is used for generating a 1099-MISC. Employers must use the W-9 Form as a tool to identify contractors for income tax purposes. You can verify the info and keep it current to ensure accurate personal information.

The Form W-9 must be updated annually and should be reviewed. It is possible to help keep the W-9 if you receive a contractor’s updated address or name changes. This form ought to be retained for a number of years by the company. It should not be sent to the Internal Revenue Service. It is intended to be used by a contractor to collect specific info.

Submitting Form w-9

Merely complete the W-9 Form and return it to the person/company requesting it. They will typically keep the completed form in their files for reference during their end-of-year accounting so that they are able to issue an correct Form 1099-NEC. 2022 Irs W9 Form