2021 Blank W9 Form – What is the W-9 form? Who needs to fill one out, and what sort of details does it ask for? Where can you get a W-9 tax return? If you want to learn the answers to these concerns, then continue to read this

What Is the W9 Form 2021

The W9 form is a form that is from the Internal Revenue Service, and the function of it is so people and companies can send their TIN to customers, financial institutions, and other individuals. You would be asked to supply a W9 form if someone paid you or plans to pay you more than $600 in a year.

If you’re a business and you’re paying independent specialists, then you will need to request a W9 from them, If you’re going to pay them over $600 each year. This form isn’t sent to the IRS unless the IRS particularly demands it.

Who Has to Fill It Out?

If you are classed as an independent professional, you need to fill out a W-9. If you work for yourself, you’ll like have to fill out this form. A few of the most common groups of individuals who should offer a W-9 form to the includes freelancer authors, translators, and even building employees, in addition to bartenders in many cases. This is just among others group of people who are normally required to supply a W9 form.

Simply put, if you’re not a staff member and your carrying out work for somebody, the possibilities are you’re needed to fill out the W-9. Remember, taxes are not gotten. This indicates you will be accountable for paying the necessary taxes to the IRS, as well as any appropriate state taxes.

Who Do You Give a W9 Form To?

You offer the form to whoever has requested it from you. They will then keep it and supply it to the IRS if they are asked to do so. When you provide your services as an independent contractor or freelancer, then the entity you offer them to will ask you to provide a W9 form that has been filled out by you.

Info It Asks For

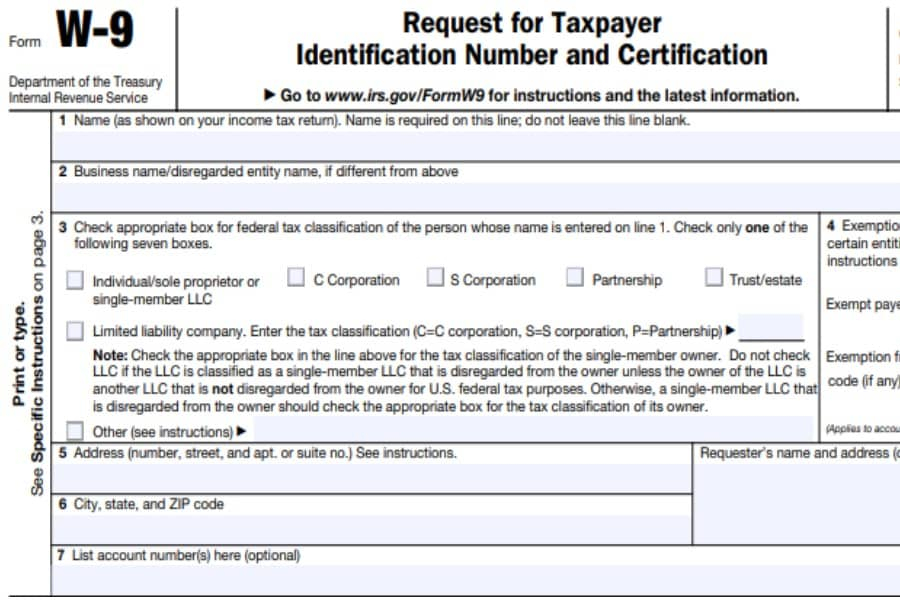

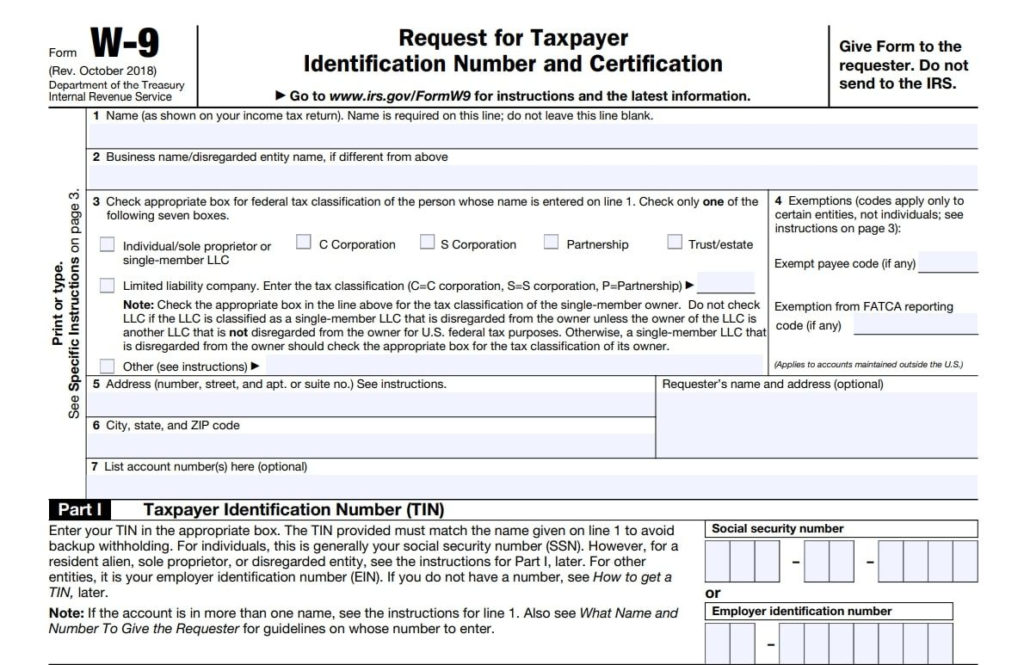

The form requests basic details such as your name, social security number or tax identification number, the city you reside in, the state, postal code, and the name of your organization, if relevant. The form also asks whether you’re a sole proprietor here, C corporation, S corporation or Partnership.

Where to Send W9 Tax Forms Printable?

You can get a W9 tax return printable copy, best online. All you do is discover a respectable source that allows you to print off a copy of the W9 form, and then print it off. You can fill it out and then send it out to the party that requested it from you once you have your form.

Download a W9 tax form printable copy today. It is fast and simple to do this. Now you know what a W9 tax form is, who has to fill the form out and what sort of information it asks. You ought to print one as soon as possible if you’re needed to fill out a W9 form.