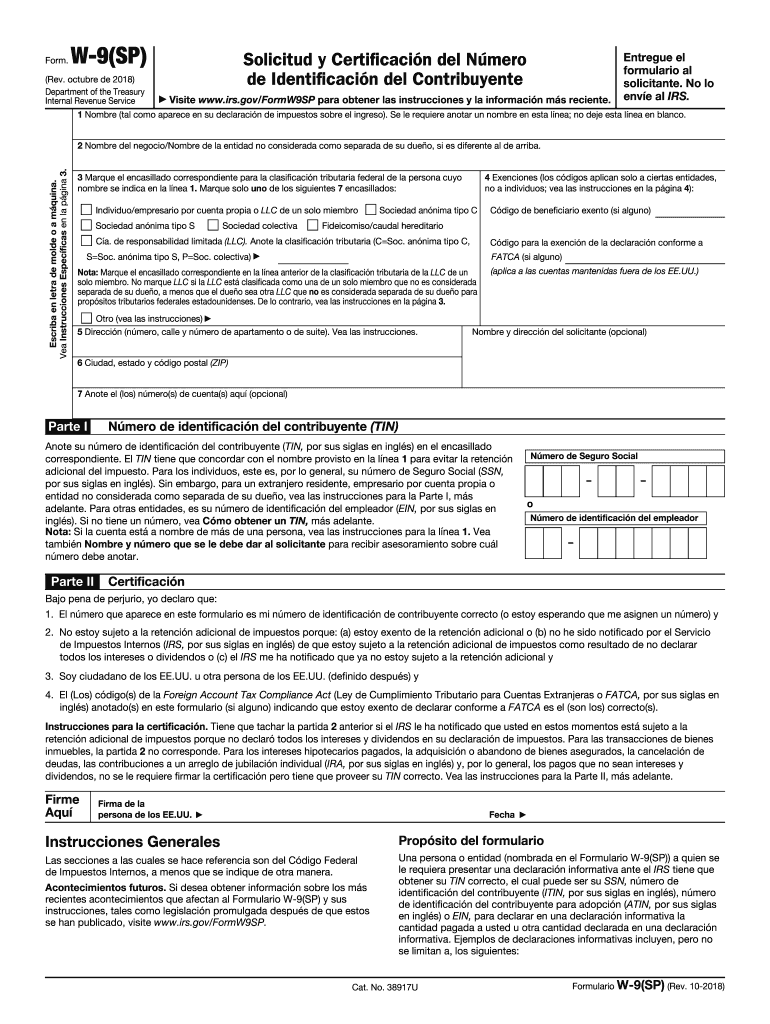

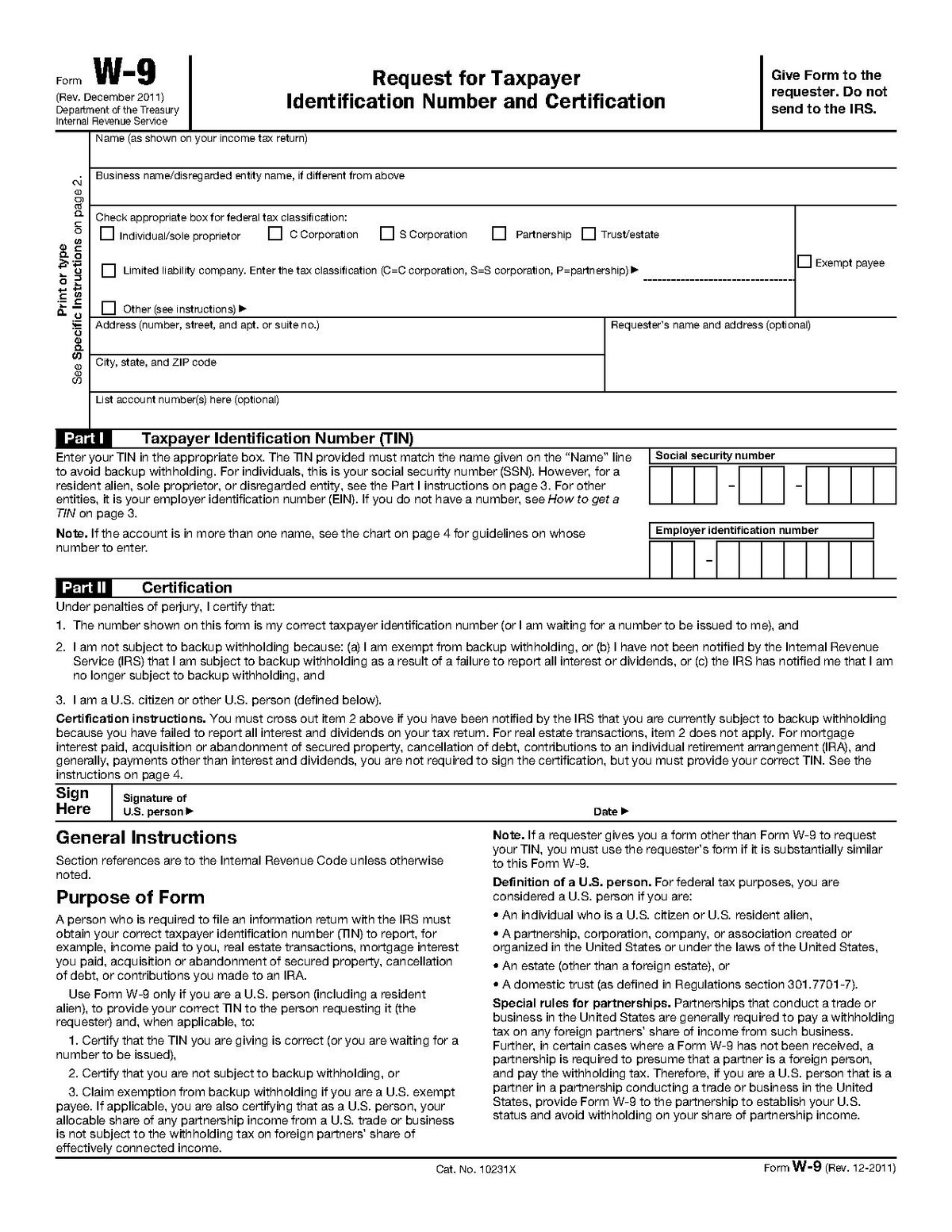

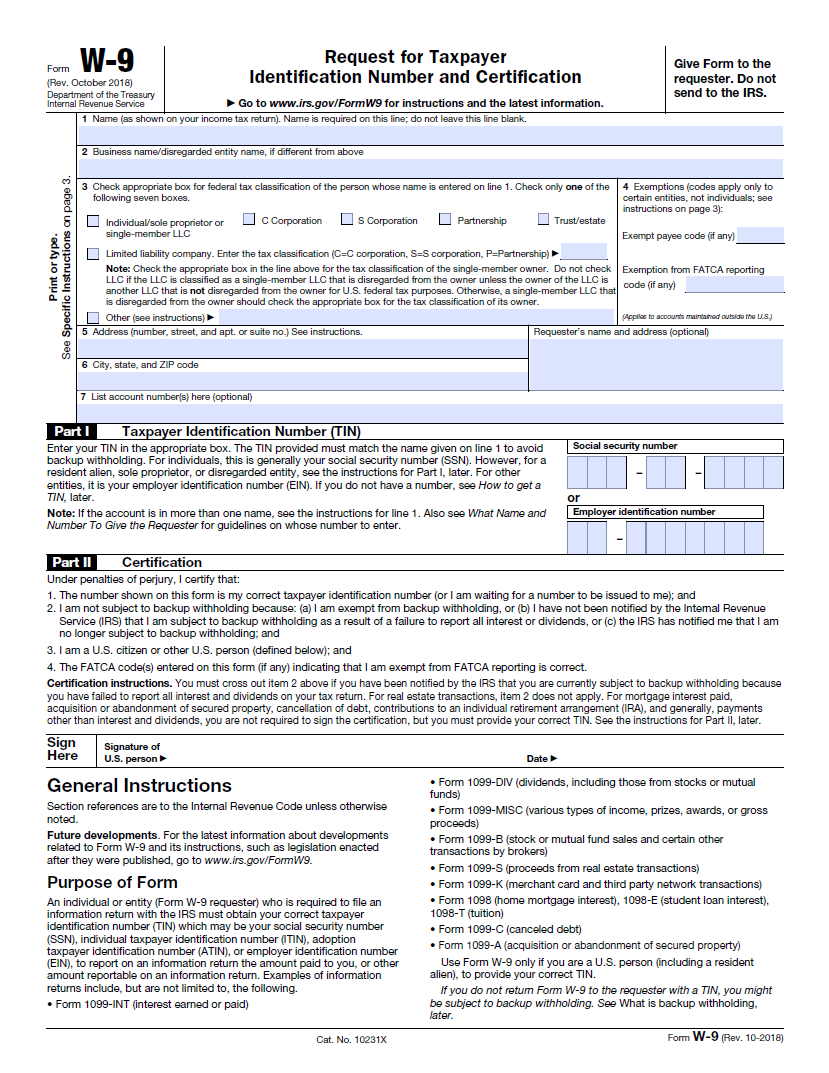

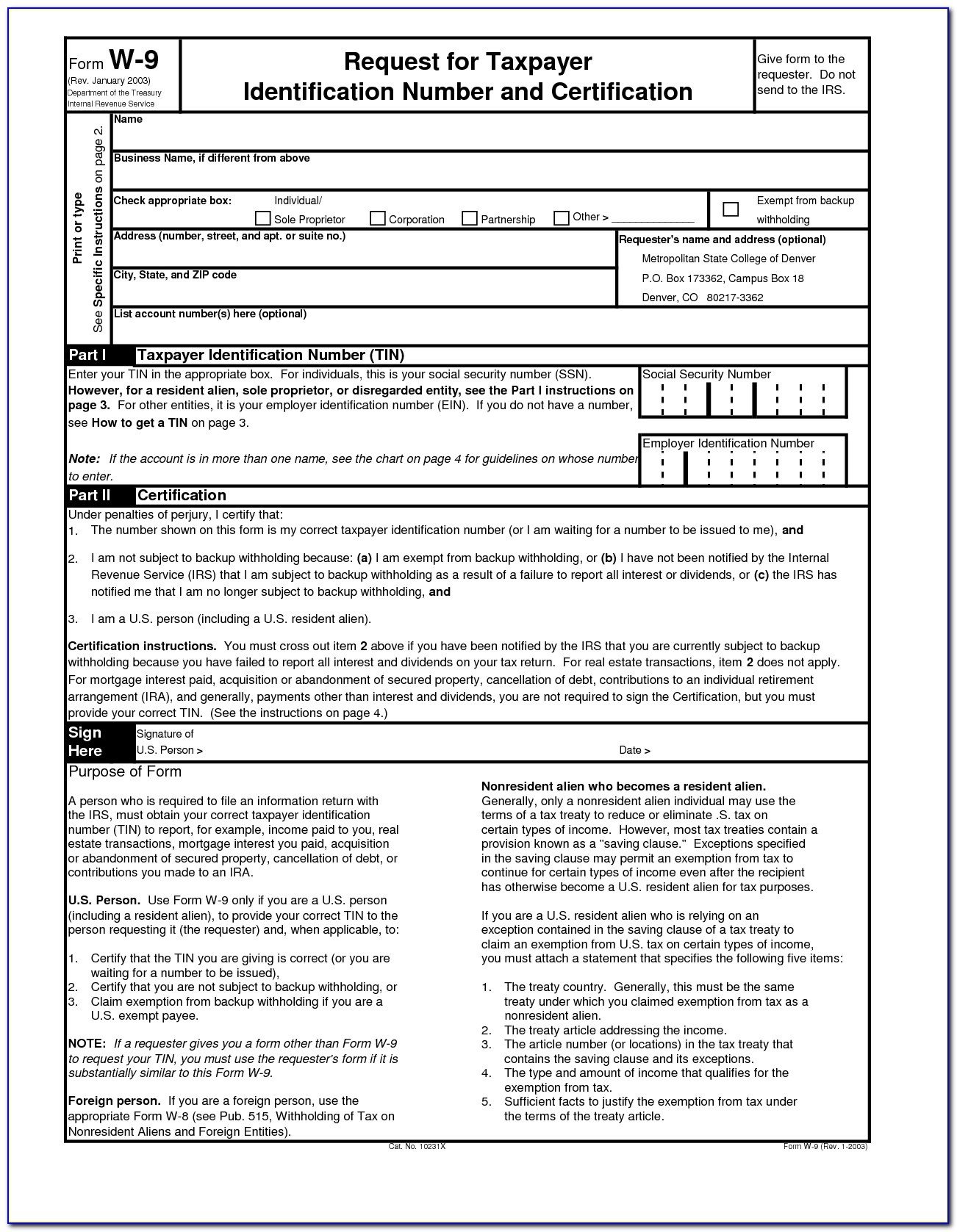

Printable W9 Form In Spanish – The IRS generally utilizes Form W-9-Request for Taxpayer Information Number and Certification. Clients may ask you to fill out and submit a W-9 form if you are a sole proprietor or independent contractor. They’ll use this information to prepare your 1099 NEC form accurately and report all payments at the end. Printable W9 Form In Spanish

What is a Printable W9 Form In Spanish

The W-9 (Request for Taxpayer ID Number and Certification form) provides a company with the essential individual info about an independent contractor or freelancer in order to file tax returns in the United States. The form asks for information such as the IC’s name, address, social security number (SSN), and more. The information is used for generating a 1099-MISC. Employers can use the W-9 Form to collect information about contractors for their income tax purposes. Verifying the information on this form and keeping it up-to-date guarantees you collected correct personal info.

Form W-9 should be reviewed and updated yearly. Contractors may provide you with updated addresses or name changes. These can be recorded for the future reference. This form should remain with the company for several decades. The Internal Revenue Service should not have it. It is intended to be used by a contractor to collect particular information.

Submitting the Form W-9

Simply return the completed W-9 form to the individual or company requesting it. The completed form will be kept in the company’s files so they are able to reference it during end-of-year accounting. Printable W9 Form In Spanish