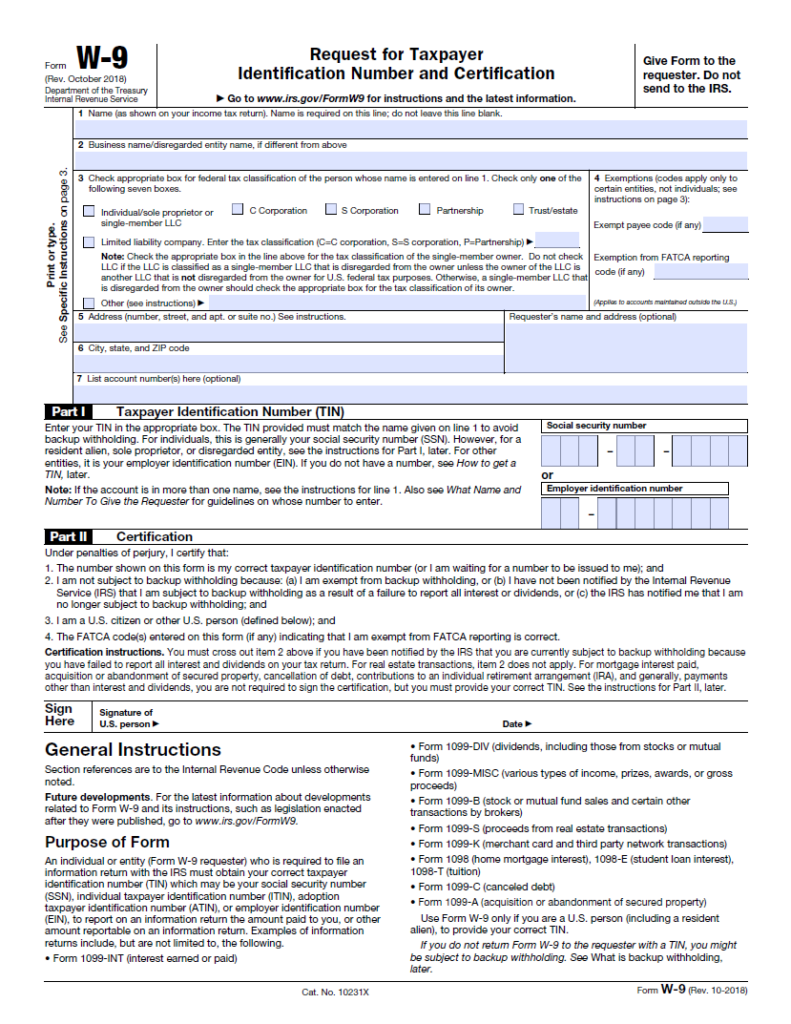

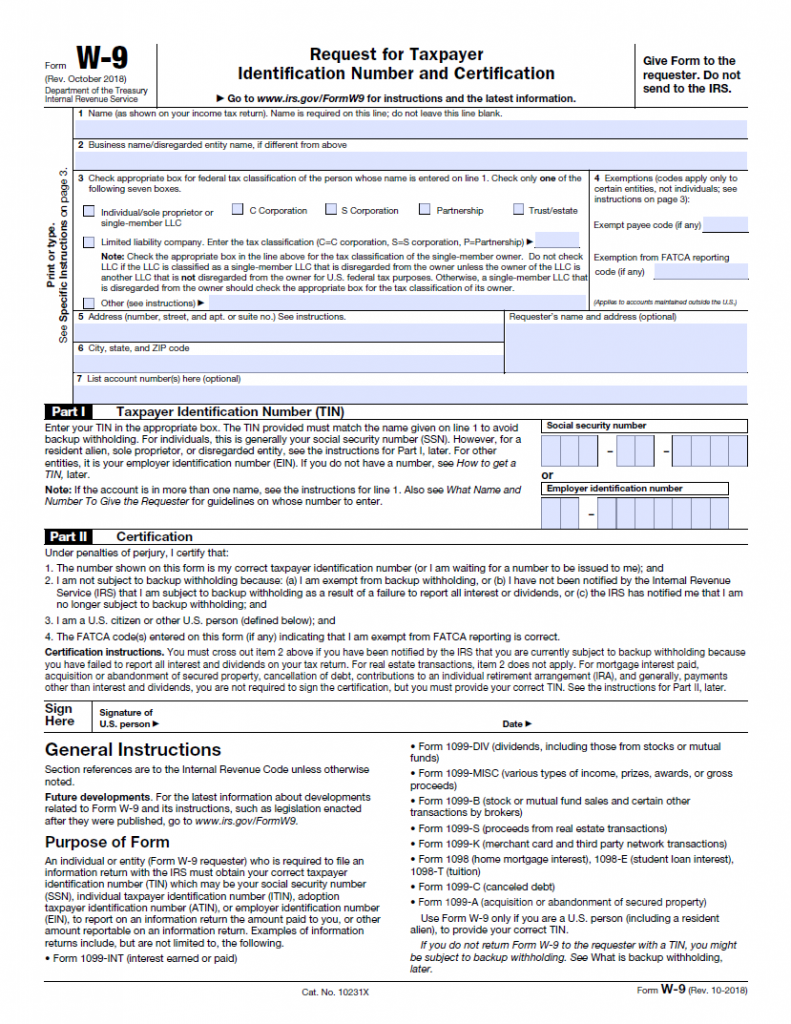

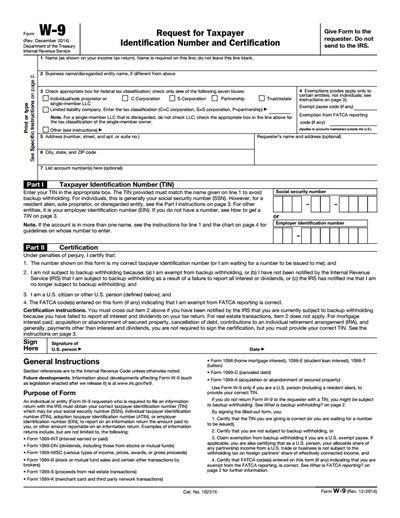

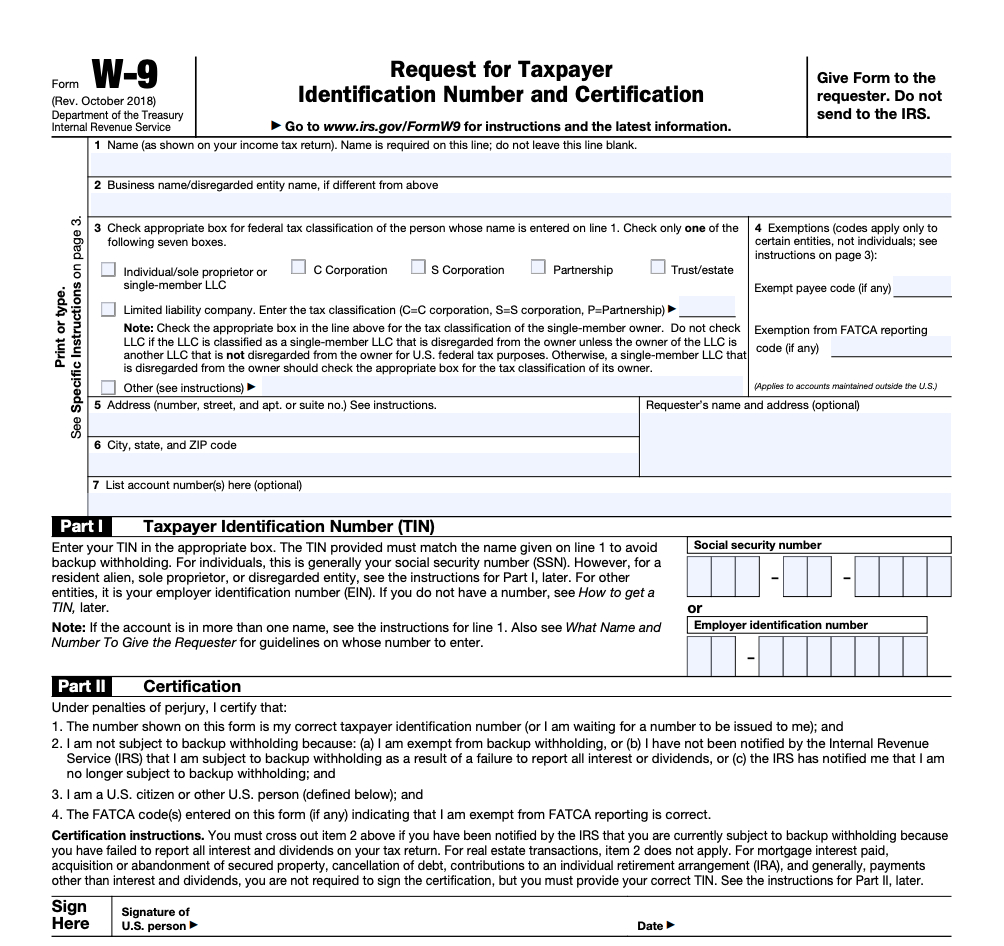

W9 Form Pdf 2022 – A common IRS form is Form W-9–Request For Taxpayer ID Number and Certification. If you have your own business or work as an independent contractor, a client may request that you fill out and send a W-9 so they can accurately prepare your 1099-NEC form and report the payments they make to you at the end of the year. W9 Form Pdf 2022

W9 Form Pdf 2022

What is the W-9 Form?

The W-9 (Request for Taxpayer ID Number and Certification form) provides a company with the essential individual information about an independent contractor or freelancer to be able to file tax returns in the United States. The form asks for information such as the IC’s name, address, social safety number (SSN), and much more. The information is used to produce a 1099-MISC. The W-9 Form is an important tool for employers to gather info about contractors for income tax purposes. Verifying the info on this form and maintaining it up-to-date guarantees you collected accurate individual info.

Form W-9 ought to be reviewed and updated yearly. It is feasible to help keep the W-9 if you obtain a contractor’s updated address or name changes. This form should remain with the business for several decades. It should not go to the Internal Revenue Service. You ought to keep in mind that the 1099 is used to provide specific information to a company.

Sending form W-9

Simply complete the W-9 Form and return it to the person/company requesting it. The completed form will probably be kept in the company’s files so they can reference it throughout end-of-year accounting. W9 Form Pdf 2022 w9 form pdf 2022