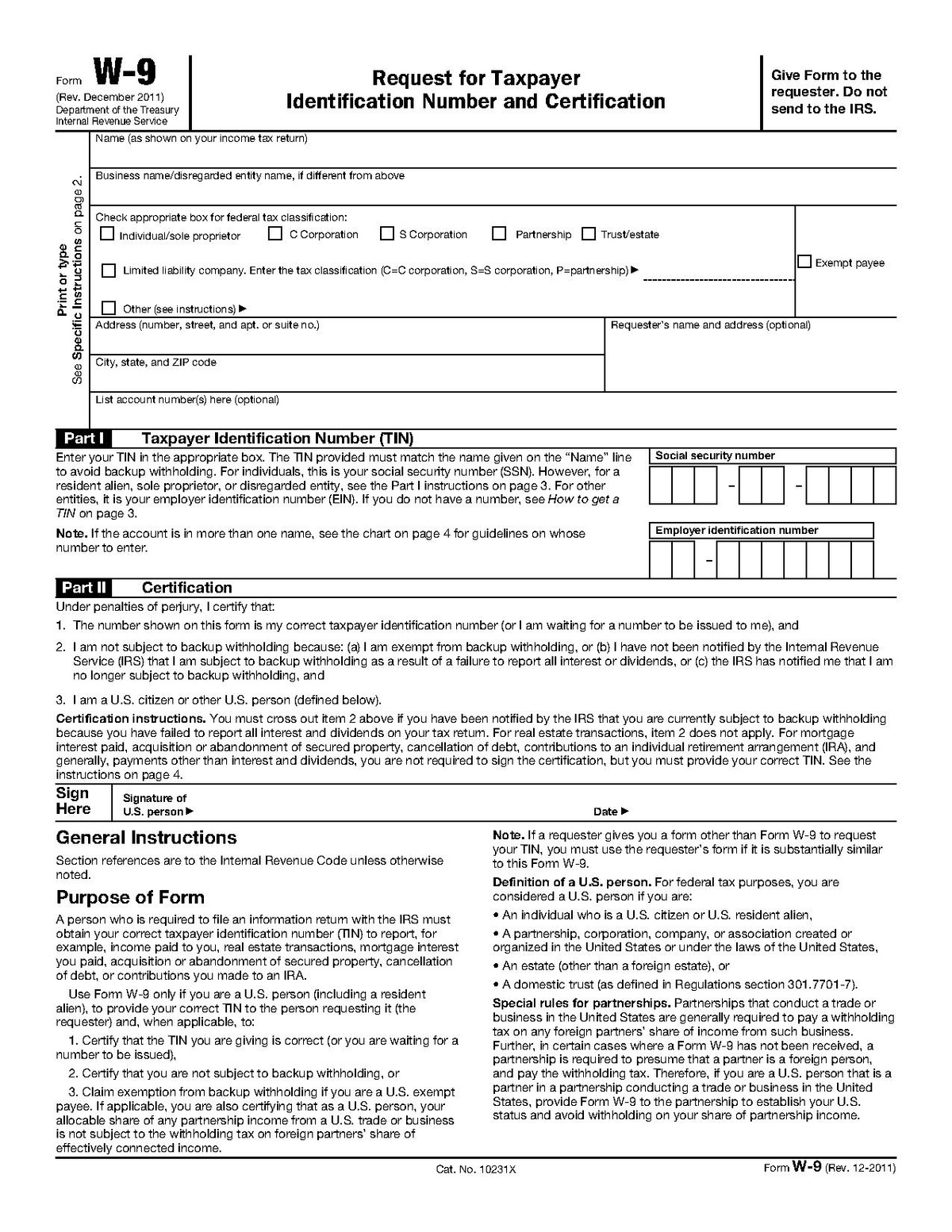

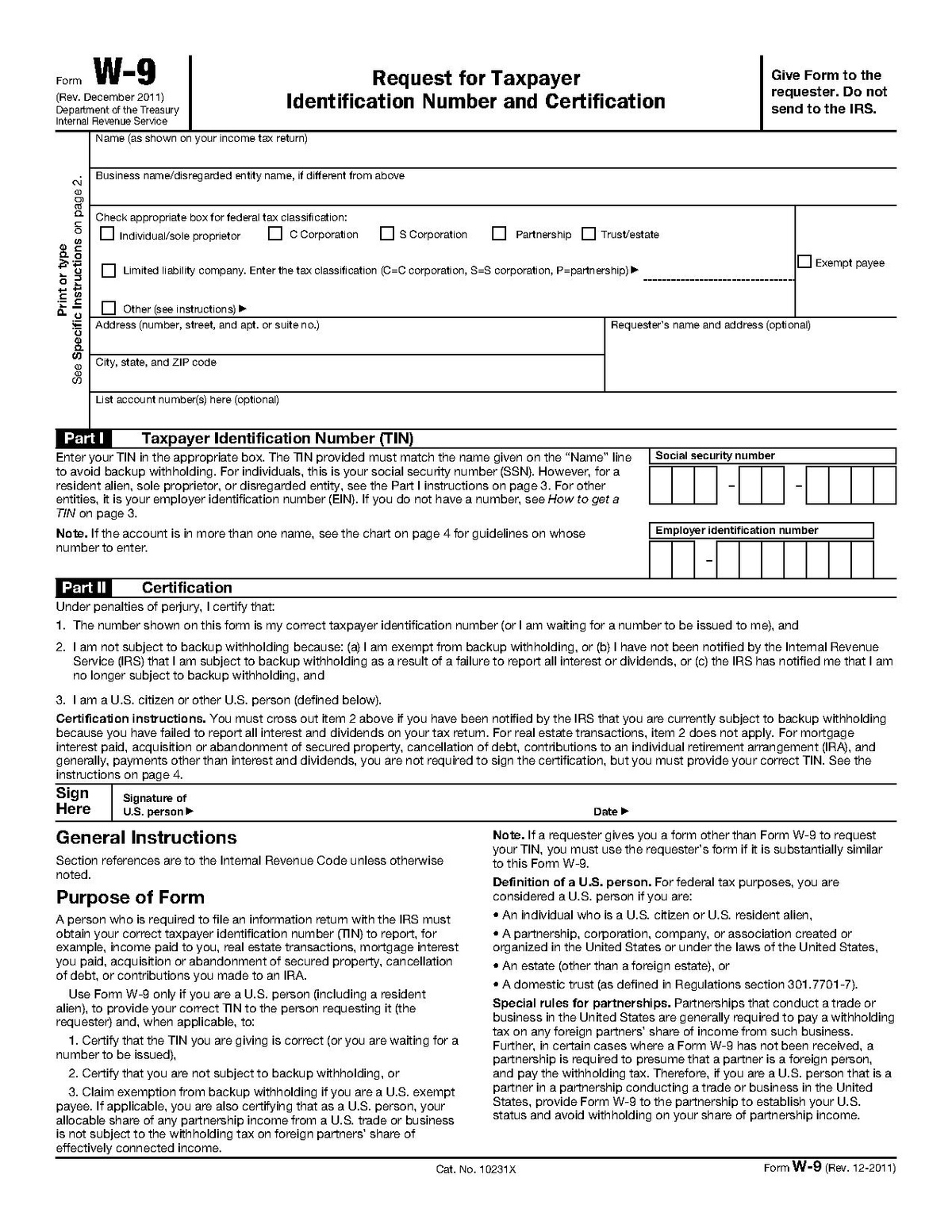

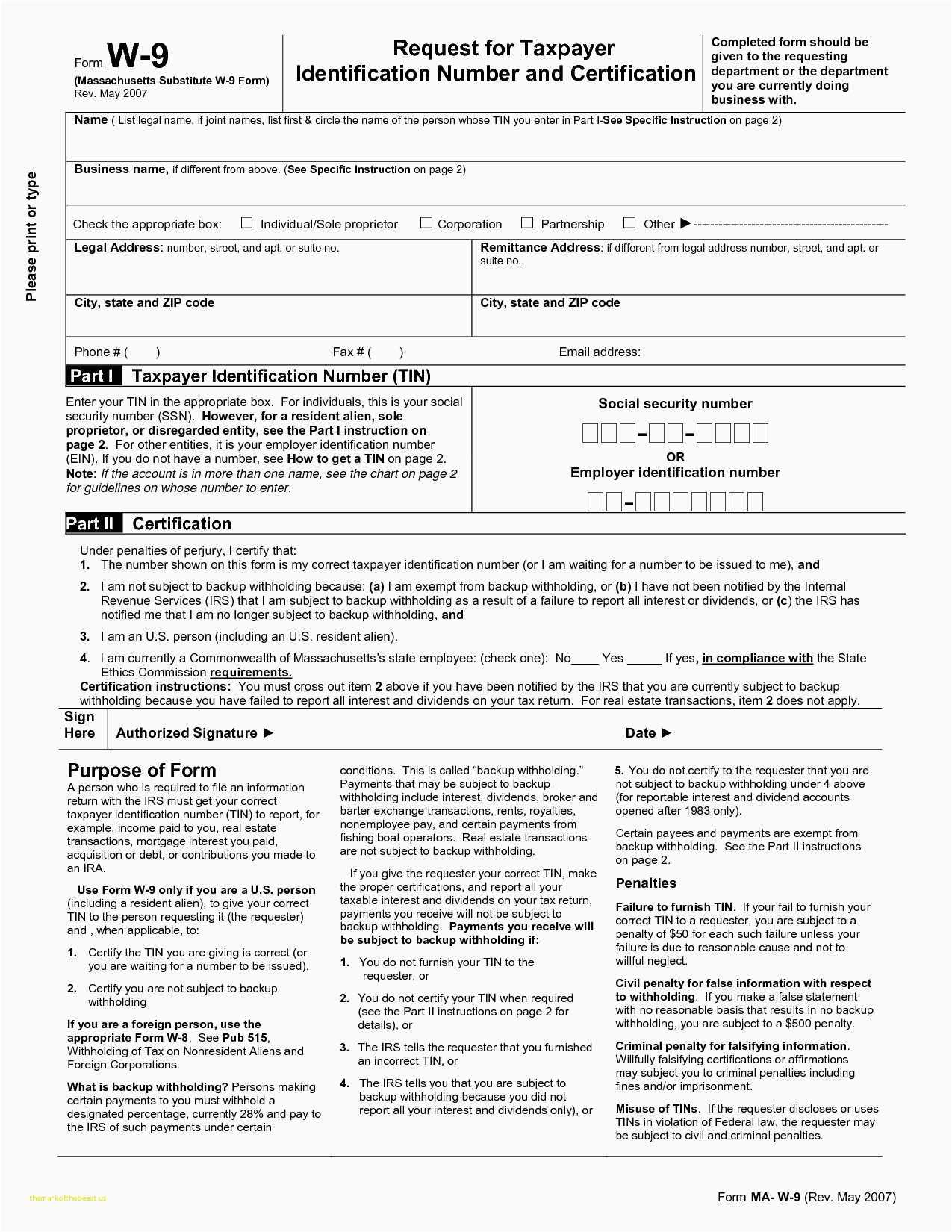

W9 Form 2022 Irs – W-9–Request to Taxpayer Identity Number and Certificate–is a common IRS form. A client might request that you total and send a W-9 if you personal a business or work independently. This may permit them to accurately prepare their 1099-NEC forms and report any payments produced to you at year’s end. W9 Form 2022 Irs

What is a W9 Form 2022 Irs ?

The W-9 or Request for Taxpayer identification Number and Certification form offers a company relevant information about a person contractor (IC), or freelancer to be used for tax purposes in America. This form asks for the IC’s name and address. The information is used for generating a 1099-MISC. Employers can use the W-9 Form to collect information about contractors for their income tax purposes. Verifying the information on this form and maintaining it up-to-date ensures you collected accurate individual info.

The Form W-9 must be updated annually and ought to be reviewed. It is feasible to help keep the W-9 if you receive a contractor’s updated address or name changes. The business should retain the information on this form for a number of years. The Internal Revenue Service shouldn’t have it. It is intended to become used by a contractor to collect specific info.

Submitting W9 Form 2022 Irs

Send the W-9 form completed to the company or individual who requested it. They will maintain the completed W-9 form in their files to become used throughout their finish of year accounting. W9 Form 2022 Irs how to fill out a w9 form 2020