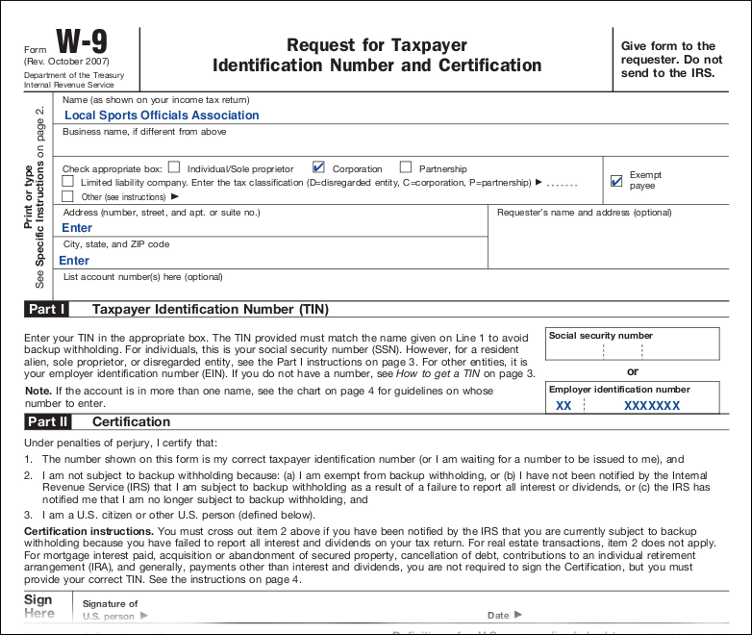

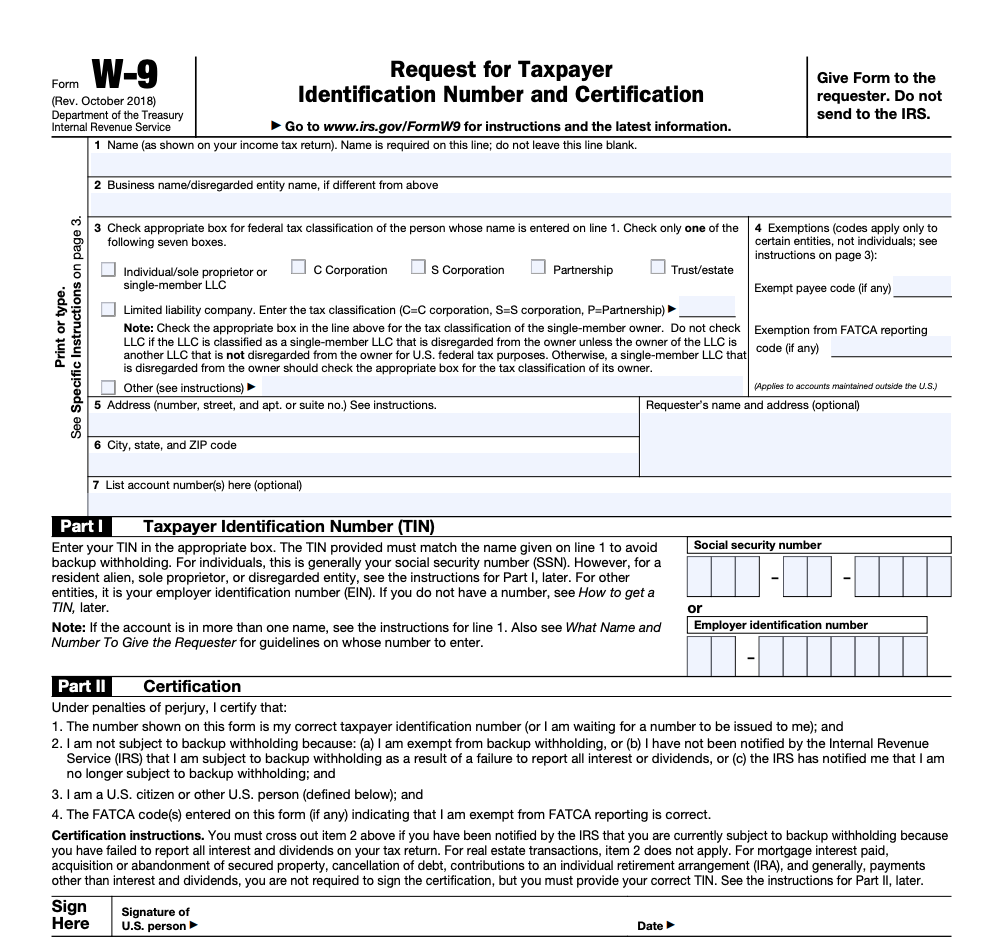

Downloadable W9 Tax Form – The IRS generally utilizes Form W-9-Request for Taxpayer Info Number and Certification. If you have your personal company or work as an independent contractor, a client may request that you fill out and send a W-9 so they can accurately prepare your 1099-NEC form and report the payments they make to you at the end of the year. Downloadable W9 Tax Form

What is a Downloadable W9 Tax Form ?

The W-9 (Request for Taxpayer ID Number and Certification form) offers a business with the essential individual information about an independent contractor or freelancer in order to file tax returns in the United States. The form requests info such as the name and address of the IC, together with their social safety number (SSN) as well as other pertinent details. The data is used for generating a 1099-MISC. Employers can use the W-9 Form to gather information about contractors for their income tax purposes. The W-9 Form is an important tool for employers to collect correct information about contractors.

The Form W-9 must be updated annually and ought to be reviewed. It is feasible to keep the W-9 if you obtain a contractor’s updated address or name changes. This form should be retained by the company for a lot of years. The Internal Revenue Service should not have it. You ought to keep in mind that the 1099 is used to supply specific info to a company.

Submitting Form w-9

The completed W-9 form ought to be returned to the company or individual who requests it. They will maintain the completed W-9 form in their files to be used during their finish of year accounting. Downloadable W9 Tax Form is there a w-9 form for 2020