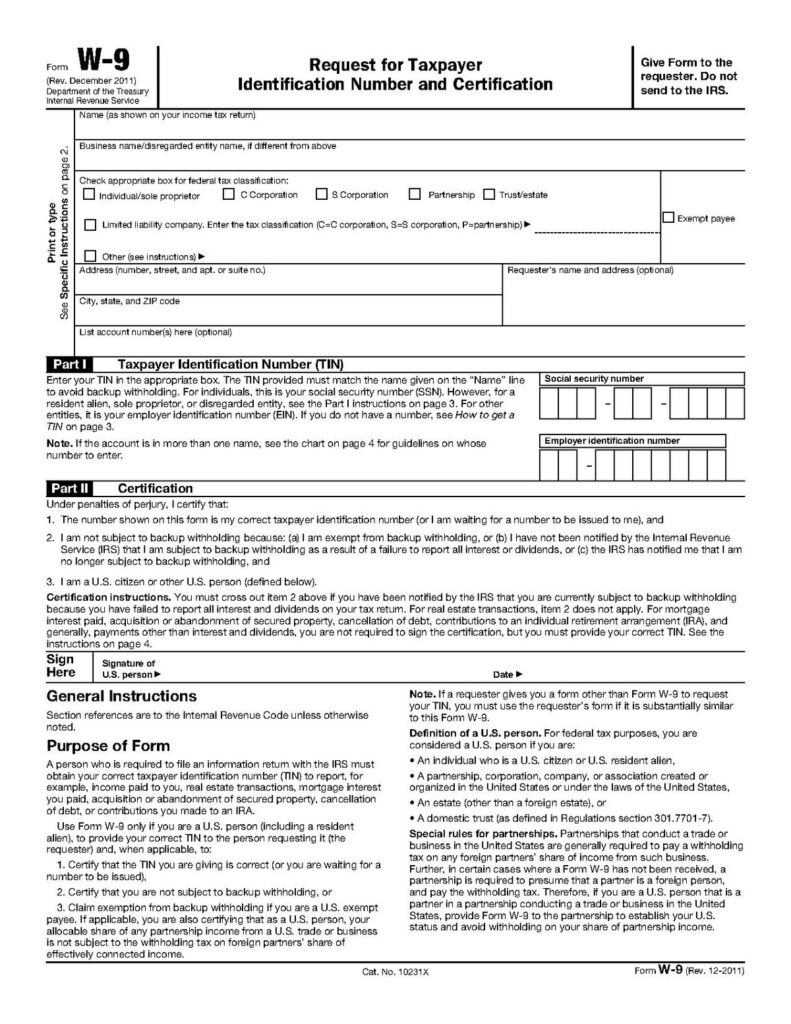

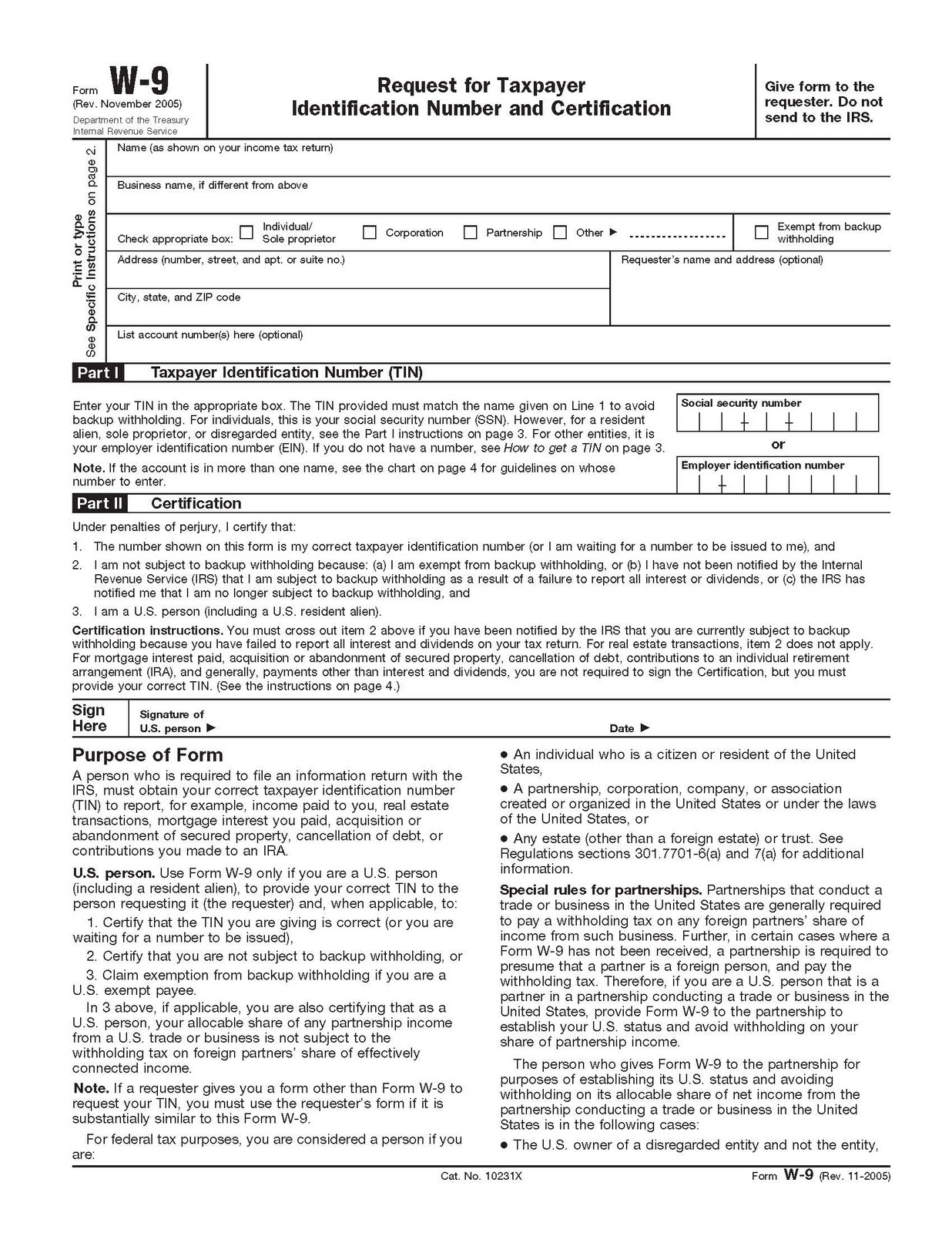

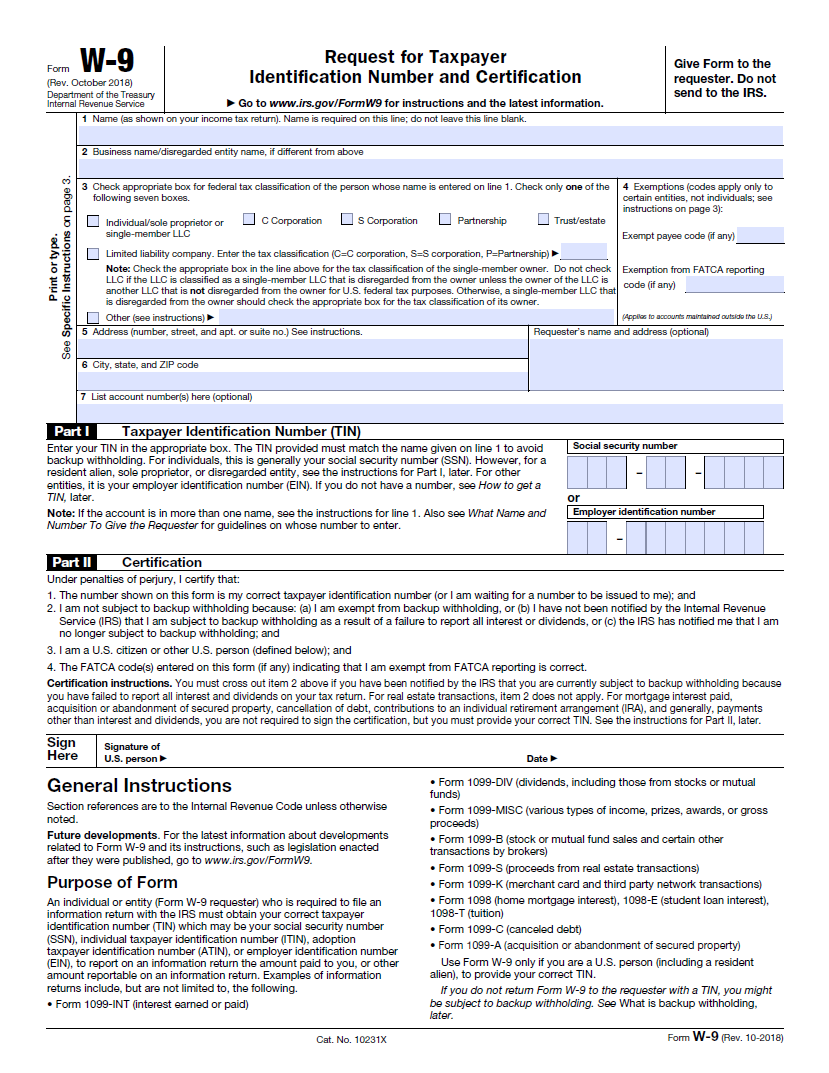

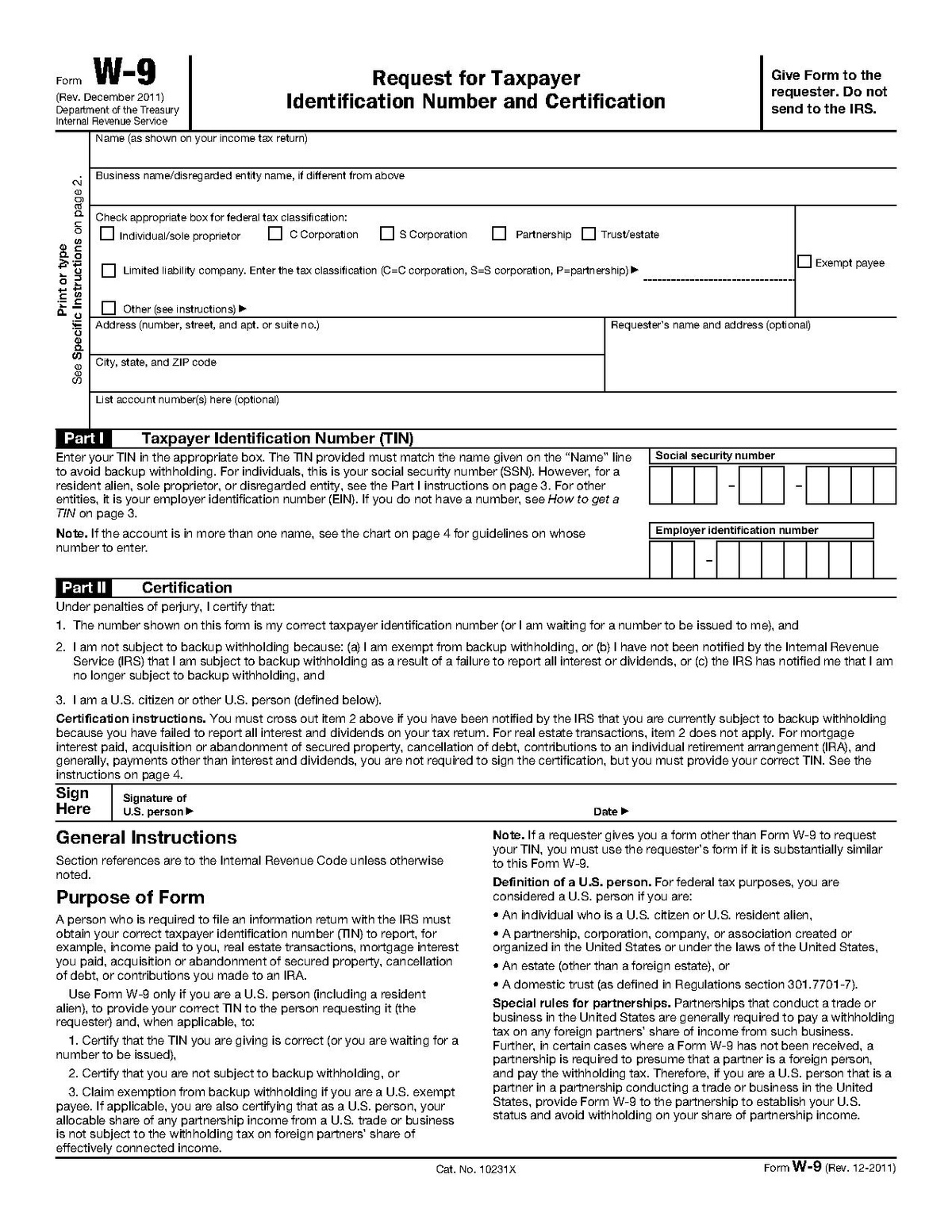

Form W9 Printable – A typical IRS form is Form W-9–Request For Taxpayer ID Number and Certification. If you have your personal company or function as an independent contractor, a client may request that you fill out and send a W-9 so they can accurately prepare your 1099-NEC form and report the payments they make to you at the finish of the year. Form W9 Printable

Form W9 Printable

What is the W-9 Form?

The W-9 (Request for Taxpayer ID Number and Certification form) offers a company with the essential personal information about an independent contractor or freelancer to be able to file tax returns in the United States. The form asks about the IC’s name and address. It also requests information like their social safety numbers (SSN), as nicely as other particulars. The data is used to generate a 1099-MISC. Employers use the W-9 form to obtain information about contractors in order to calculate their income tax. Verifying the info on this form and keeping it up-to-date ensures you collected correct personal information.

Form W-9 ought to be reviewed and updated yearly. It is feasible to keep the W-9 if you obtain a contractor’s updated address or name changes. This form should remain with the business for a number of decades. It should not be sent to the Internal Revenue Service. Bear in mind that this is a tool for gathering specific information. A company must total 1099 if the contractor earns more than a particular quantity during the tax-year.

Submitting the Form W-9

Merely total the W-9 Form and return it to the person/company requesting it. The completed form will probably be kept in the company’s files so they are able to reference it during end-of-year accounting. Form W9 Printable w9 form 2022 printable