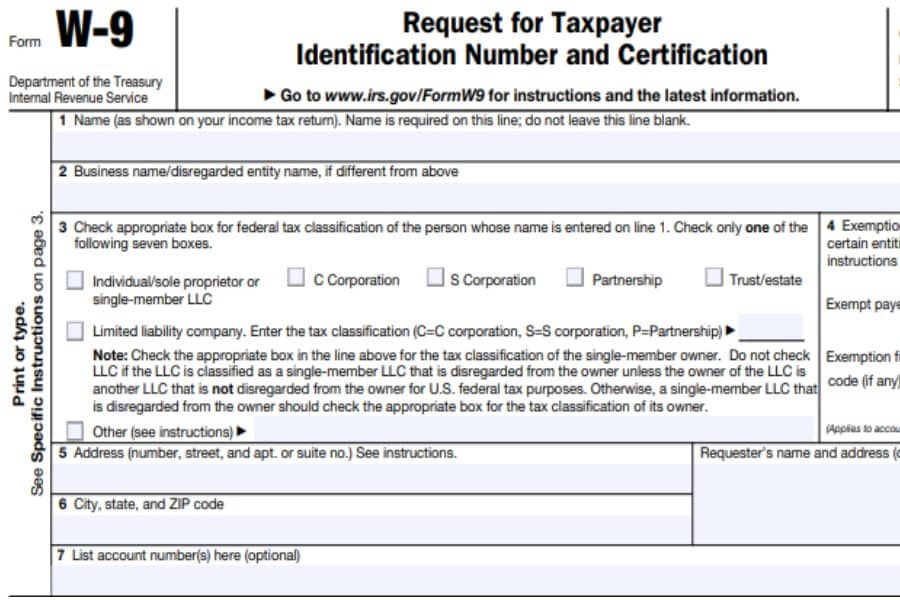

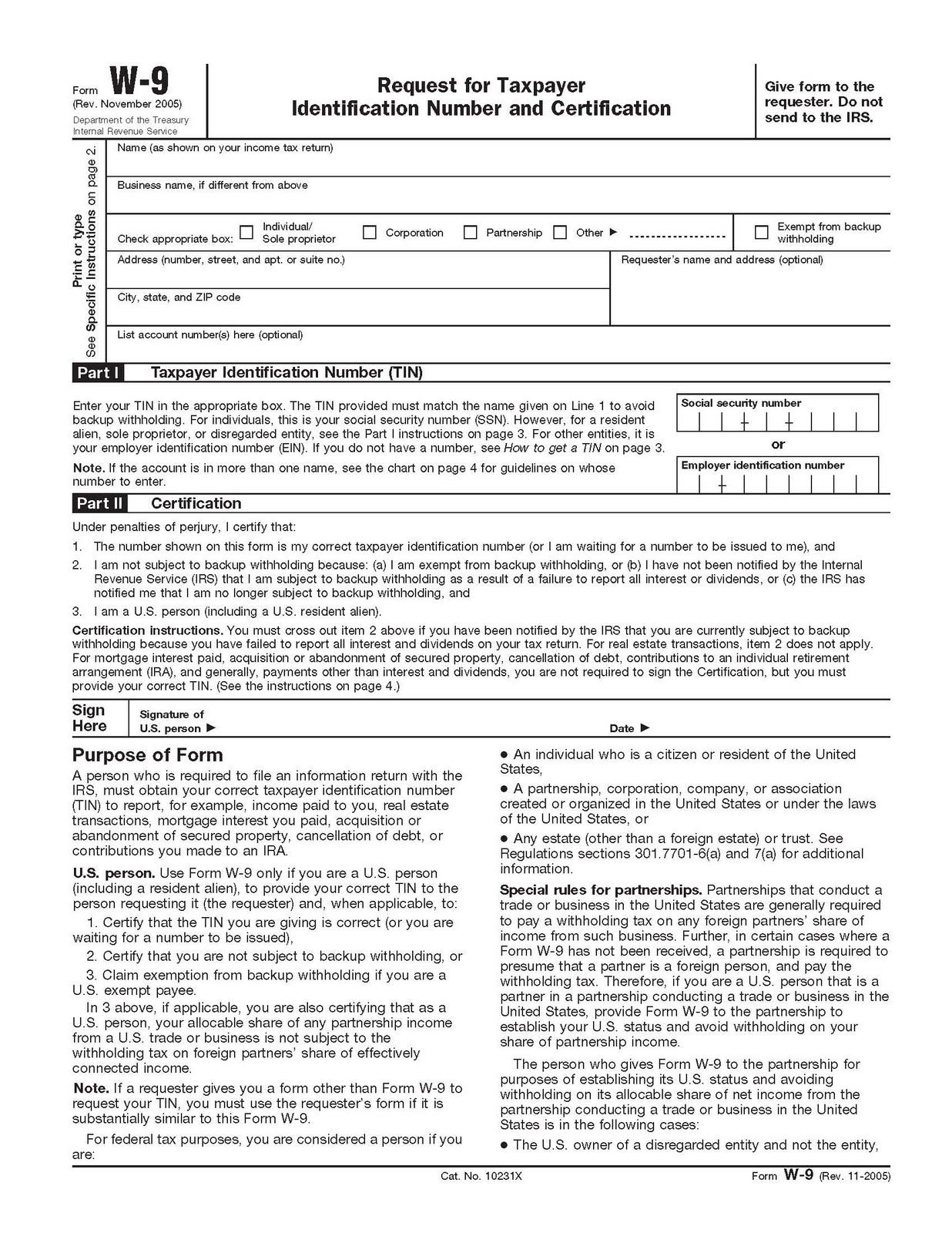

Free Printable W9 Form – The IRS generally utilizes Form W-9-Request for Taxpayer Info Number and Certification. Customers may ask you to fill out and submit a W-9 form if you are a sole proprietor or independent contractor. They will use this info to prepare your 1099 NEC form accurately and report all payments at the end. Free Printable W9 Form

What is a Free Printable W9 Form ?

The W-9, or Request for Taxpayer Identification Number and Certification form, provides a business with relevant individual information about an independent contractor (IC) or freelancer for tax purposes in the United States. The form demands info such as the IC’s name, address, and social security number (SSN). This information is used in order to produce a 1099 MISC. Employers need to have the W-9 form in place to get info on contractors for income-tax purposes. The W-9 Form is an essential tool for employers to gather correct information about contractors.

Annually, you ought to review and update Form W-9. It is possible to help keep the W-9 if you receive a contractor’s updated address or name changes. This form ought to be retained by the company for many years. It shouldn’t go to the Internal Revenue Service. You ought to keep in mind that the 1099 is used to provide specific information to a company.

Sending form W-9

The completed W-9 form should be returned to the company or person who requests it. They’ll frequently maintain the completed forms in their files to ensure that they are able to problem a correct Form 1099 -NEC at the finish of the year. Free Printable W9 Form