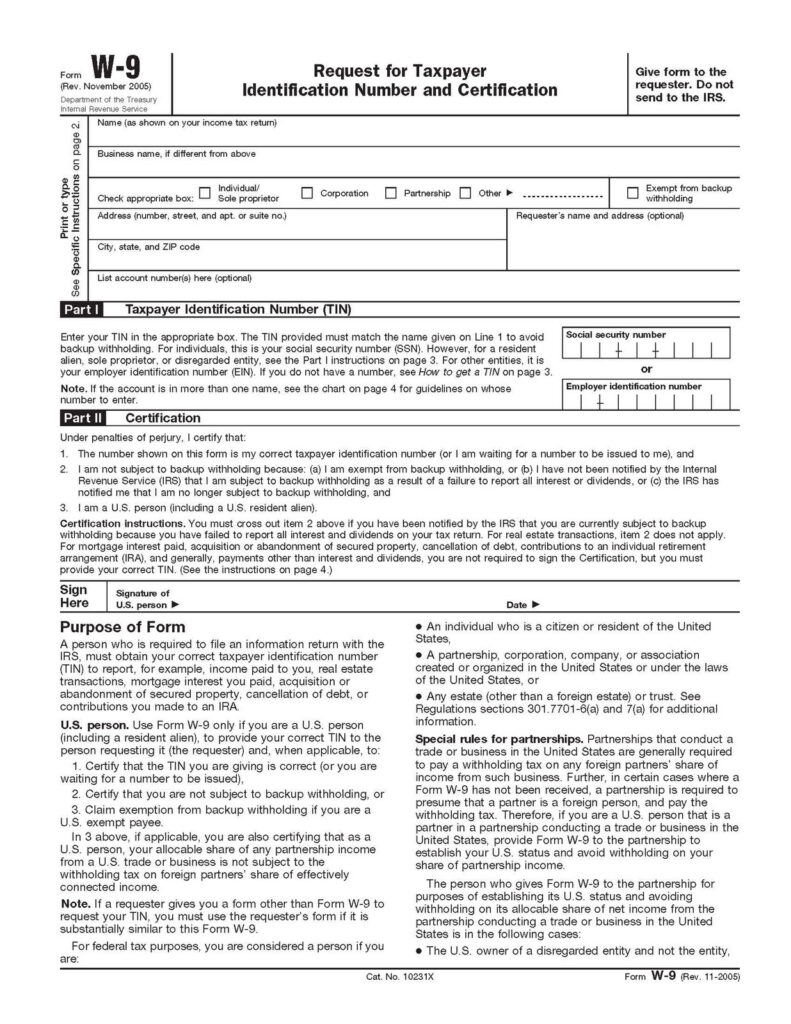

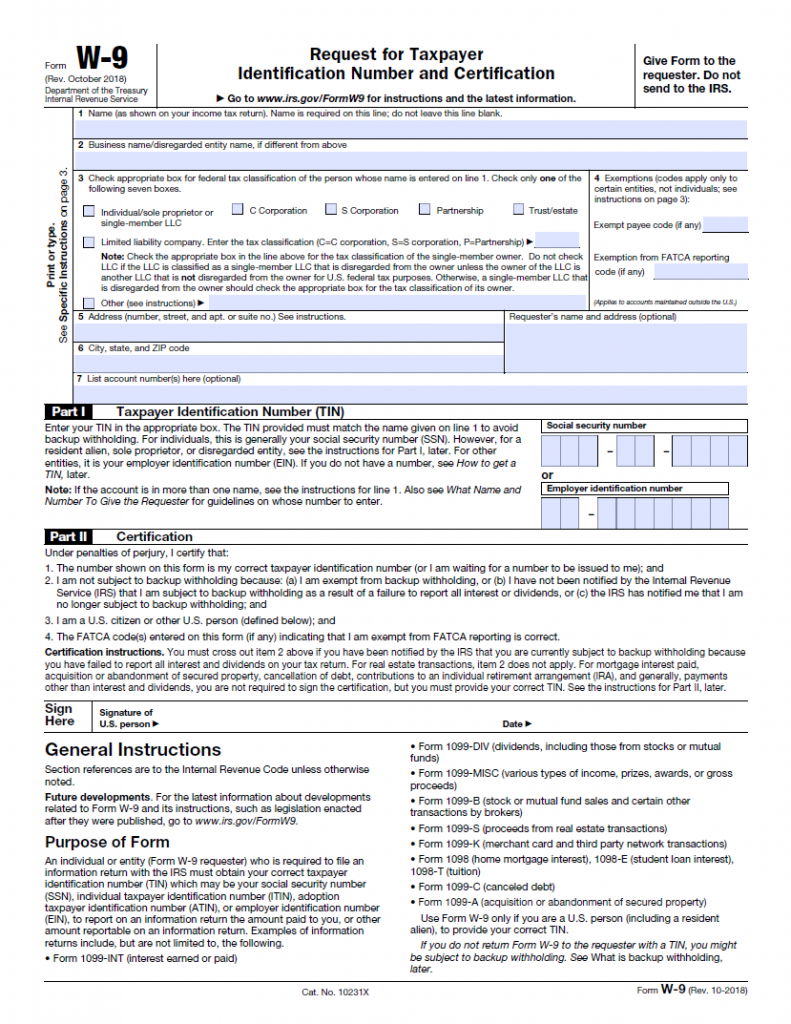

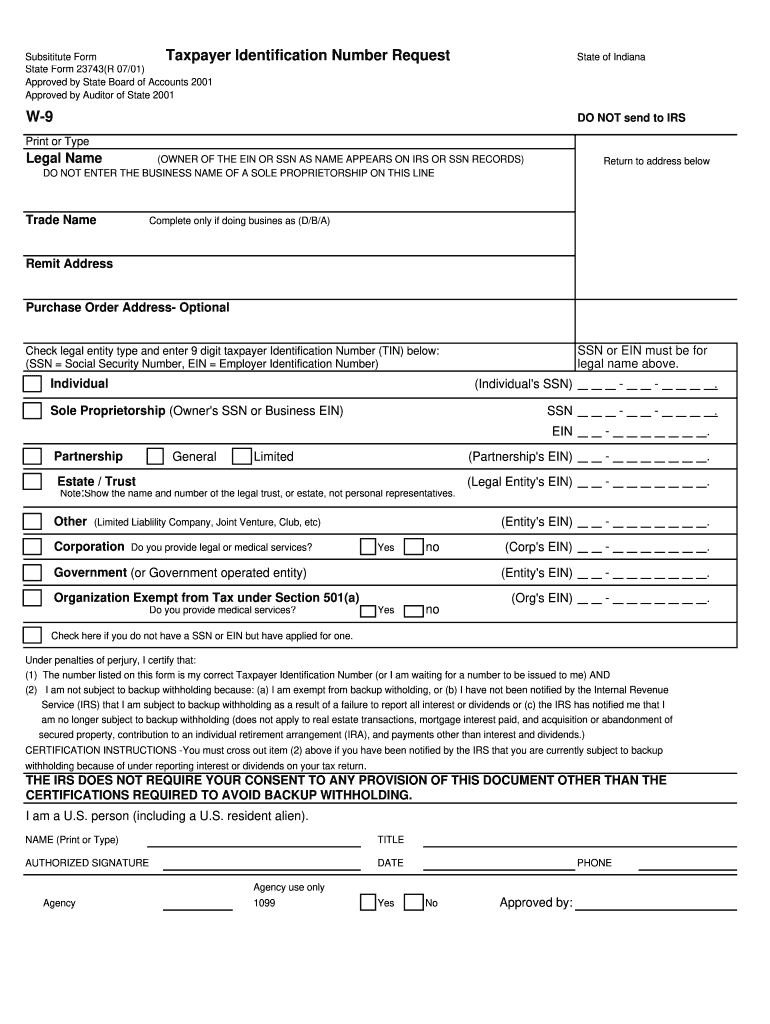

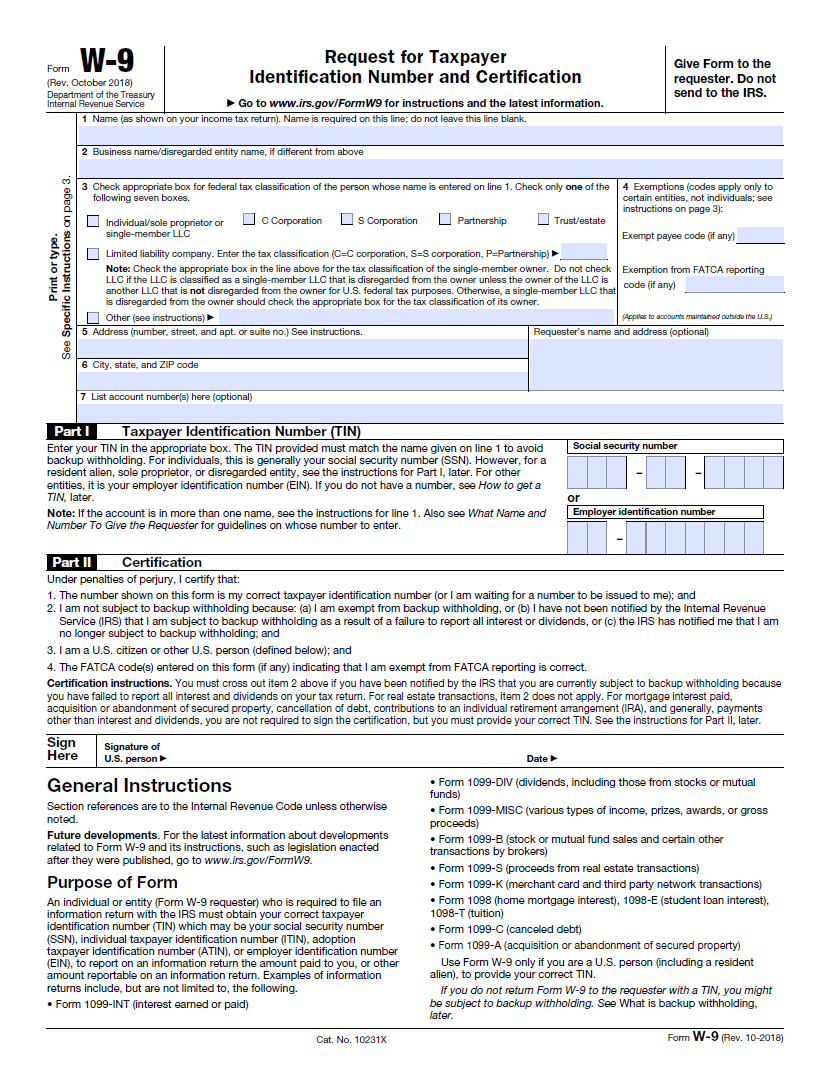

Printable W9 Form Word Version – A typical IRS form is Form W-9–Request For Taxpayer ID Number and Certification. You may be asked by customers to complete and mail a W-9. The client will need it to correctly prepare your 1099-NEC and report the payments that they produced at the end. Printable W9 Form Word Version

Printable W9 Form Word Version

What is a Printable W9 Form Word Version ?

The W-9, also recognized as Request for Taxpayer Identity Number and Certificate, is a form that offers businesses with personal info concerning an independent contractor (IC), or freelancer, for tax purposes in the United States. The form asks for information such as the IC’s name, address, social security number (SSN), and more. This information is used to create a 1099MISC. The W-9 Form is an essential tool for employers to gather info about contractors for income tax purposes. Verifying the information on this form and keeping it up-to-date ensures you collected accurate individual information.

The Form W-9 must be updated annually and should be reviewed. If a contractor provides you an updated address or name change, these changes may be recorded for future reference. This form ought to be retained for a number of years by the business. The Internal Revenue Service should not receive it. Remember that it is a tool to gather specific information that a business needs to total 1099 if the contractor earns more than a certain amount throughout the tax year.

Sending form W-9

Just return the W-9 form filled out to the requester. They will typically keep the completed form in their files for reference throughout their end-of-year accounting so that they are able to problem an accurate Form 1099-NEC. Printable W9 Form Word Version