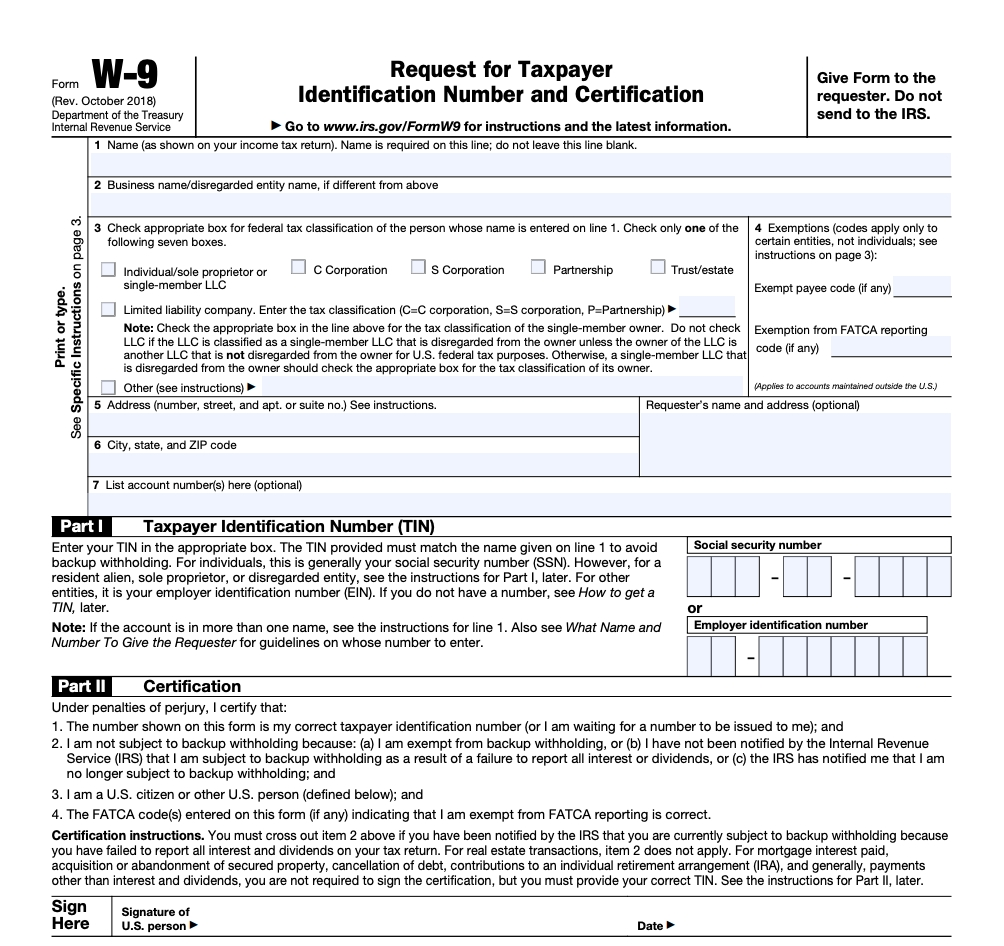

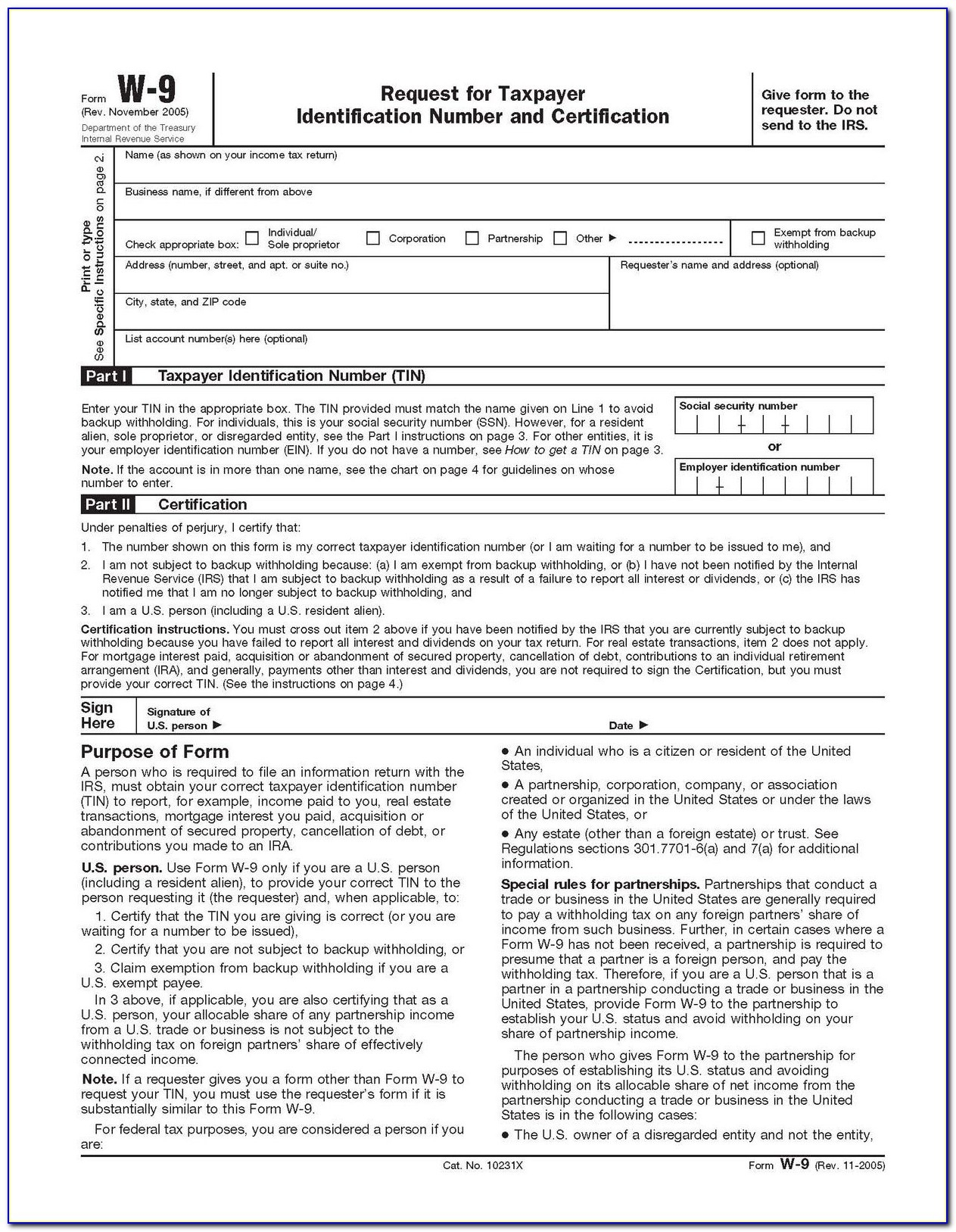

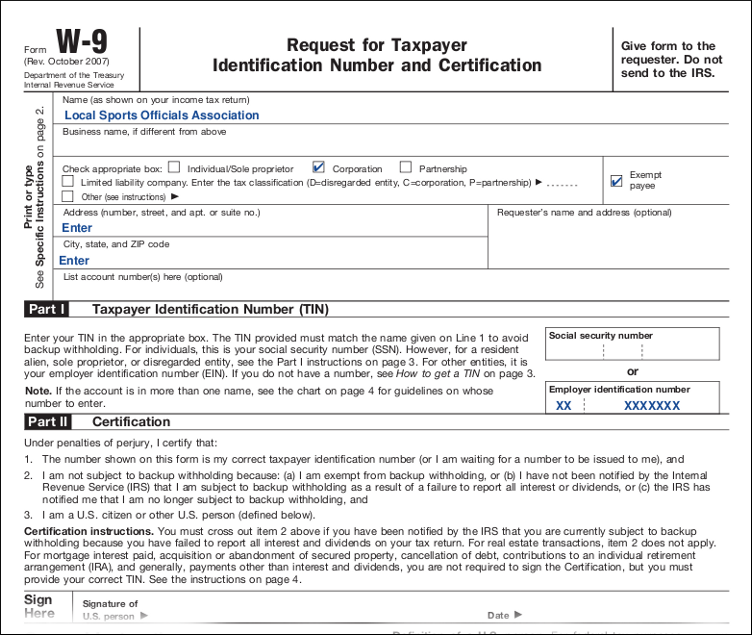

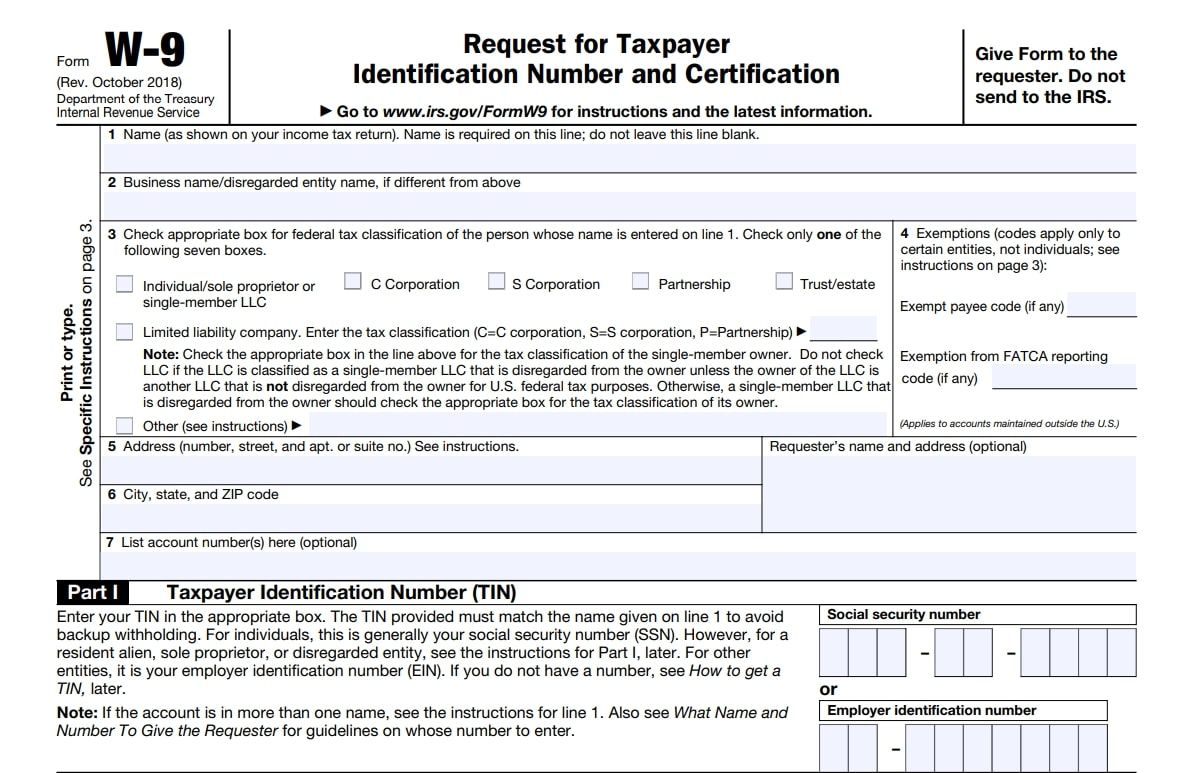

W9 Tax Form Template – The IRS commonly utilizes Form W-9-Request for Taxpayer Information Number and Certification. A client might request that you total and send a W-9 if you personal a company or work independently. This will permit them to accurately prepare their 1099-NEC forms and report any payments produced to you at year’s end. W9 Tax Form Template

What is a W9 Tax Form Template ?

The W-9, or Request for Taxpayer Identification Number and Certification form, offers a company with relevant individual information about an independent contractor (IC) or freelancer for tax purposes in the United States. This form asks for the IC’s name and address. The data is used to generate a 1099-MISC. The W-9 Form is an essential tool for employers to collect information about contractors for income tax purposes. The W-9 Form is an important tool for employers to collect accurate information about contractors.

The Form W-9 should be updated annually and should be reviewed. You may need to record any changes in address or names supplied by contractors. This form ought to be retained for several years by the company. It should not be sent to the Internal Revenue Service. Bear in mind that this is a tool for gathering particular information. A company should total 1099 if the contractor earns more than a particular quantity throughout the tax-year.

Submitting Form w-9

Just return the W-9 form filled out to the requester. They’ll maintain the completed W-9 form in their files to be used throughout their end of year accounting. W9 Tax Form Template