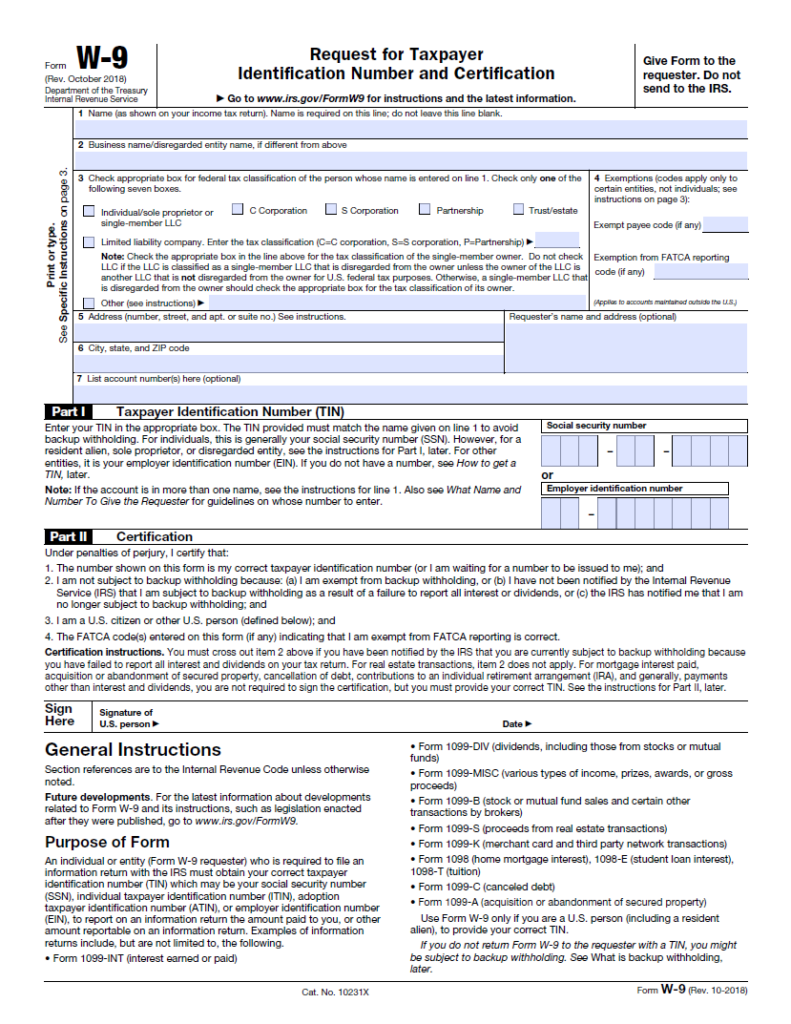

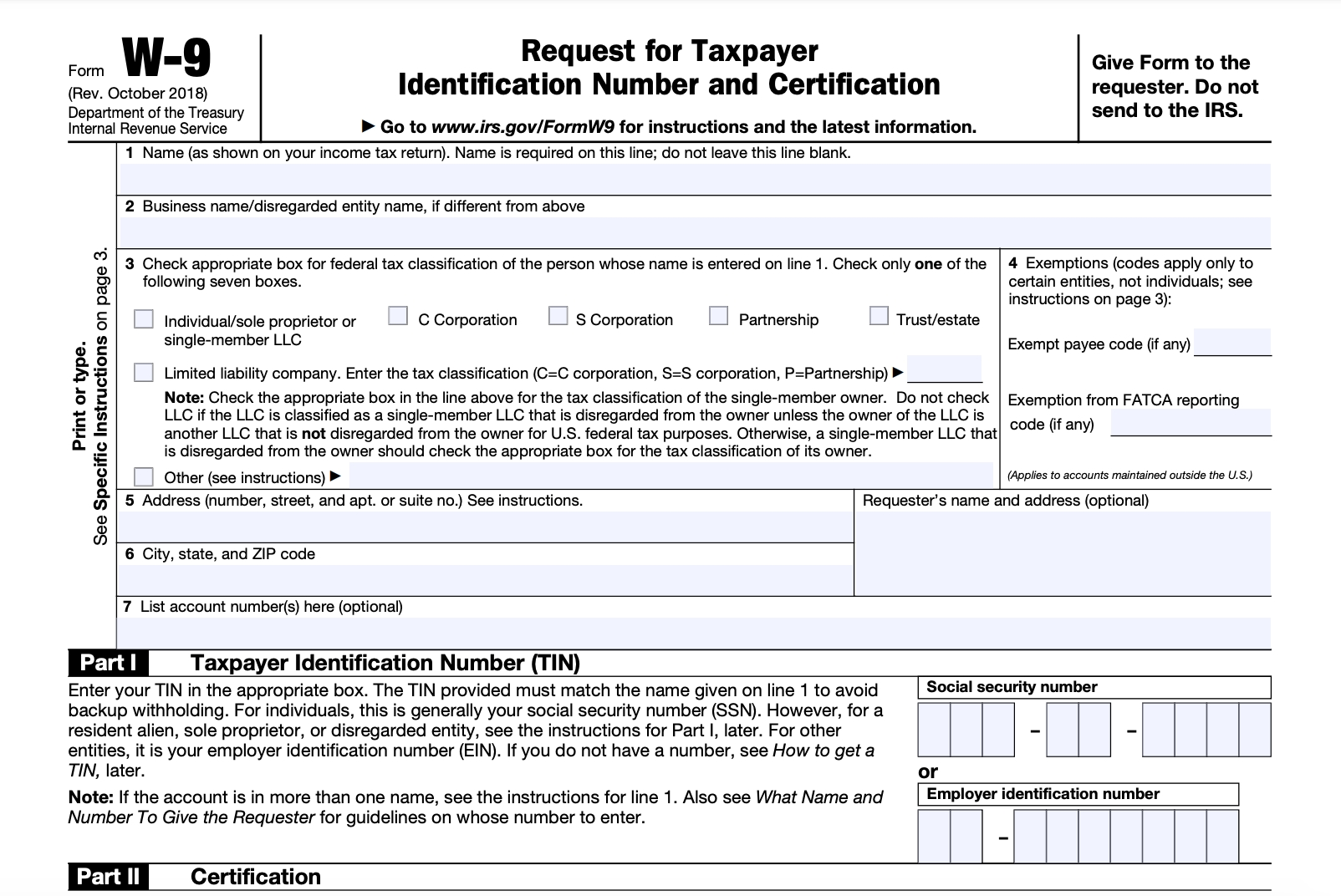

W9 Form 2022 What Is It – The IRS forms W-9, Request for Taxpayer Identification Number (and Certification) are all commonly used. You may be asked by clients to complete and mail a W-9. The client will require it to correctly prepare your 1099-NEC and report the payments that they made at the finish. W9 Form 2022 What Is It

W9 Form 2022 What Is It

What is the W-9 Form?

The W-9 (Request for Taxpayer ID Number and Certification form) offers a business with the essential individual information about an independent contractor or freelancer in order to file tax returns in the United States. The form demands information such as the IC’s name, address, and social safety number (SSN). This information is used to make a 1099MISC. Employers use the W-9 form to obtain info about contractors to be able to calculate their income tax. To ensure you gather correct personal information, verify it and maintain it updated.

Form W-9 should be reviewed and updated yearly. If a contractor gives you an updated address or name alter, these changes may be recorded for future reference. This form ought to be retained for a number of years by the company. The Internal Revenue Service shouldn’t have it. You ought to bear in mind that the 1099 is used to supply specific info to a company.

Send Form W9 Form 2022 What Is It

Just return the W-9 form filled out to the requester. They’ll generally maintain the completed form in their file for reference throughout their finish year accounting, to ensure that they are able to problem an precise Form 1099-NEC. W9 Form 2022 What Is It w-8 form vs w-9 form